The Ethereum (ETH) worth elevated above $3,500 on February 29 however has fallen barely since.

Ethereum elevated above a confluence of short- and long-term resistance ranges in the course of the upward motion.

Ethereum Reaches $3,500

The weekly time-frame technical evaluation exhibits the ETH worth has been buying and selling inside a long-term ascending parallel channel since June 2022. The value made two unsuccessful breakout makes an attempt (purple icons).

ETH lastly broke out in February 2024. The breakout (inexperienced circle) additionally took it above the center of a long-term vary between $1,400 – $4,000 (white).

Yesterday, ETH reached a excessive of $3,522, the very best worth since March 2022.

The weekly Relative Energy Index (RSI) provides a bullish studying. Merchants make the most of the RSI as a momentum indicator to evaluate whether or not a market is overbought or oversold and whether or not to build up or promote an asset.

If the RSI studying is above 50 and the development is upward, bulls nonetheless have a bonus, but when the studying is under 50, the other is true. The indicator is above 70 (inexperienced icon) and rising, each indicators of a bullish development.

Learn Extra: What Is Wrapped Ethereum (WETH)?

What Are Analysts Saying?

Some cryptocurrency merchants and analysts on X posit that that is just the start of a bigger Ethereum development.

Altstreetbets used an Elliott Wave depend to foretell the ETH worth will enhance to $5,500.

InmortalCrypto believes ETH will increase to $10,000, whereas IncomeSharks famous his target of $3,500 has been reached.

Byzantine Common outlined his causes for the bullish ETH prediction.

“However everyone seems to be already chubby ETH, it might probably’t pump anymore.” No lil bro. Solely a small terminally ailing part of this area of interest neighborhood on simply twitter is chubby ETH. That’s, within the grand scheme of issues, nothing,” he stated.

Learn Extra: What’s Ethereum Restaking?

ETH Value Prediction: Is $4,000 Subsequent?

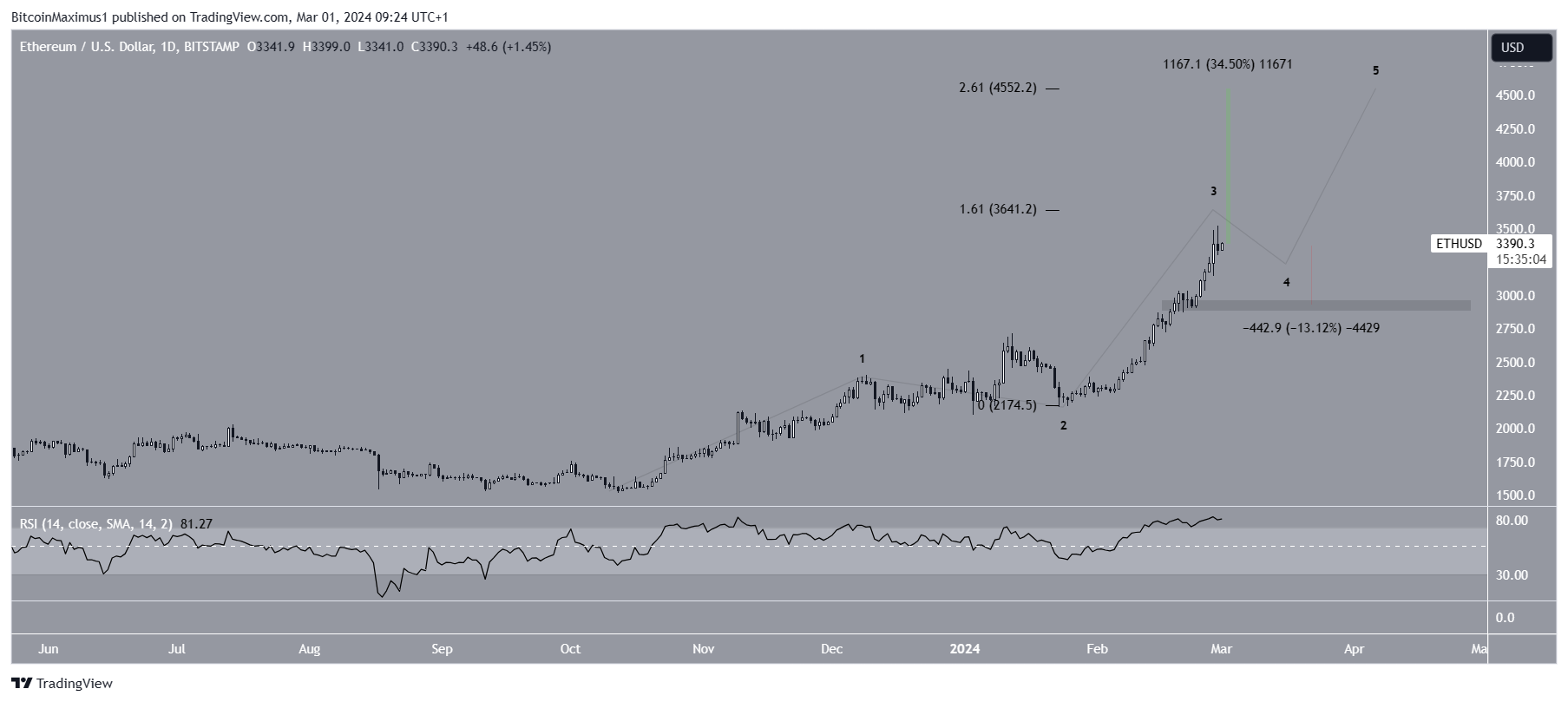

The technical evaluation of the each day time-frame helps the upward motion due to the wave depend and RSI. Technical analysts make the most of the Elliott Wave principle to determine the development’s route by learning recurring long-term worth patterns and investor psychology.

The most definitely wave depend means that ETH is in wave three of a five-wave upward motion (black). To date, wave three has had 1.61 instances the size of wave one. It is a potential degree for a prime.

Nevertheless, the each day RSI doesn’t present any weak spot for the reason that indicator remains to be rising.

So, if ETH breaks out from the $3,640 resistance, it might probably enhance by one other 35% to the subsequent resistance at $4,550, giving waves one and three a 1:2.61 ratio.

Regardless of this bullish ETH worth prediction, failure to interrupt out from $3,640 can set off a 13% drop to the closest help at $3,000. This might full wave 4.