Binance has unveiled eight pivotal narratives poised to sculpt the crypto market’s future in 2024.

This forecast, rooted within the vibrant progress and innovation of the previous yr, provides a glimpse into what lies forward.

Crypto Market Traits to Dominate 2024

On the forefront, Bitcoin continues to claim its dominance. The yr 2023 was marked by important strides in Bitcoin’s journey, together with the introduction of improvements like Ordinals and BRC-20 tokens and the institution of spot Bitcoin ETFs, culminating within the much-anticipated 2024 halving occasion.

Learn extra: Bitcoin Halving Cycles and Funding Methods: What To Know

In keeping with Binance, these developments and favorable SEC rulings will doubtlessly inject heightened exercise and volatility into Bitcoin’s orbit. Digital belongings like Ordinals and BRC-20 tokens will doubtlessly expertise dramatic shifts as a result of their memecoin-like qualities and smaller market caps.

Parallel to Bitcoin’s ascent, the rise of the possession economic system, enabled by blockchain expertise, is reshaping consumer management over knowledge and artistic content material. The earlier yr noticed a surge in decentralized bodily community infrastructure (DePin) and decentralized social media (DeSoc). Notably, platforms like Buddy.tech led substantial progress in DeSoc.

“These protocols are seen as having excessive progress potential as a result of their in depth complete addressable market and their capability to scale quickly by bottom-up progress methods,” Binance wrote.

As these DePin and DeSoc tasks proceed to develop in 2024, they promise enhanced management and monetization alternatives for customers over their digital belongings.

The Integration of AI and Cryptocurrencies

One other rising crypto narrative is the combination of Synthetic Intelligence (AI) with cryptocurrency. Sparked by the worldwide traction of OpenAI’s ChatGPT in 2023, this synergy is opening new avenues in commerce automation, predictive analytics, and knowledge administration.

As AI intertwines with the crypto ecosystem, it has the potential to democratize AI mannequin coaching. It additionally has the potential to boost transparency and safety by decentralized storage, which is turning into more and more evident.

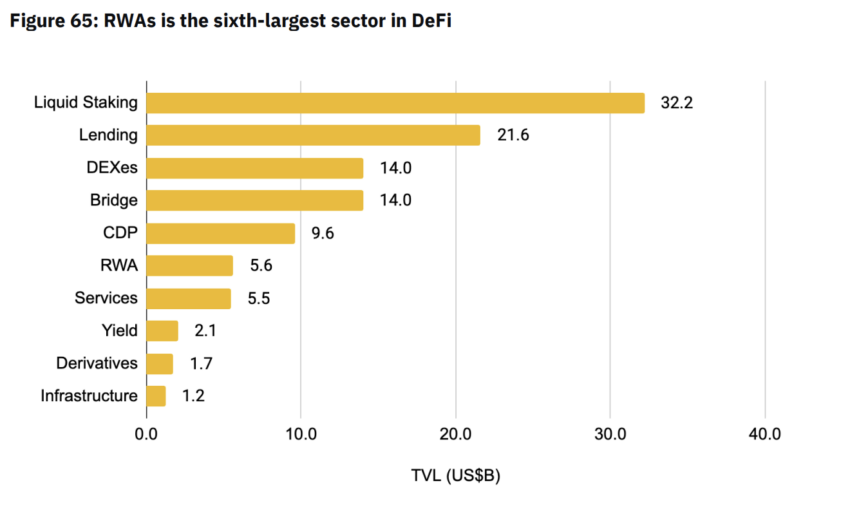

Concurrently, the tokenization of Actual-World Belongings (RWAs) is revolutionizing blockchain utility. This course of is bringing off-chain belongings onto the blockchain, enhancing transparency and effectivity within the course of.

Learn extra: What’s The Impression of Actual World Asset (RWA) Tokenization?

As 2024 unfolds, tokenized treasuries, buoyed by elevated rates of interest, are rising as a pretty yield supply for crypto buyers. Furthermore, accelerated institutional adoption of RWAs, alongside developments in associated infrastructures like decentralized id and oracles, will possible bolster this pattern.

Even Larry Fink, CEO of BlackRock, highlighted tokenization as a groundbreaking technological development that might revolutionize asset administration.

“We’ve got the expertise to tokenize at the moment. If in case you have a tokenized safety and id, the second you purchase or promote an instrument on a common ledger, that’s all created collectively. You need to speak about points round cash laundering. This eliminates all corruption by having a tokenized system,” Fink defined.

Different Crypto Narratives to Pay Consideration To

Relating to on-chain liquidity, a elementary element of the DeFi ecosystem, Binance believes {that a} important evolution is underway. Subtle liquidity fashions, comparable to Uniswap V3’s Concentrated Liquidity Market Maker (CLMM) and Request for Quote (RFQ) techniques, are reshaping this market sector.

These fashions, designed to deal with challenges like Impermanent Loss and Simply-In-Time liquidity, point out the rising sophistication and potential inside on-chain buying and selling. Furthermore, they’re anticipated to raise the size and accessibility of on-chain monetary actions.

Hand in hand with the evolution of on-chain liquidity is the accelerated institutional adoption of cryptocurrencies. Furthermore, the entry of heavyweight asset managers like BlackRock and Constancy into the crypto market signifies a sturdy perception within the trade’s long-term potential.

The forthcoming Bitcoin halving will possible draw much more institutional gamers into the crypto trade. CoinShare research reveals the common price of manufacturing per Bitcoin post-halving is prone to rise to between $27,900 and $37,800. This can place just a few miners to stay worthwhile, additional impacting the cryptocurrency market.v

“The price of manufacturing and profitability buildings for miners will change following the 2024 halving… Most miners will face challenges necessitating price reductions to stay worthwhile. Solely a handful of miners are anticipated to function profitably if Bitcoin costs stay [below] $40,000,” analysts at CoinShares famous.

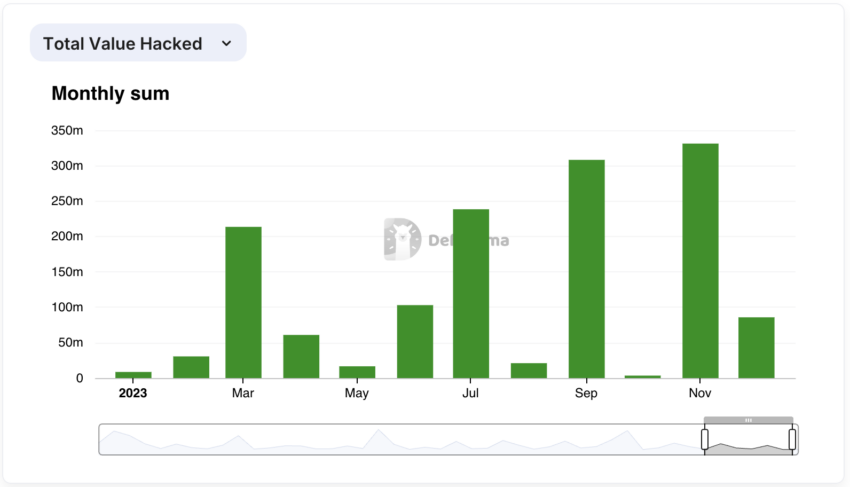

Within the backdrop of those thrilling developments, safety stays a paramount concern. The trade has made commendable strides in enhancing safety measures, as evidenced by decreased DeFi exploits. Nonetheless, the concentrate on fortifying defenses stays unwavering.

Lastly, the significance of account abstraction is coming to the fore. It’s a essential step in making blockchain expertise extra accessible and inclusive. Improvements on this area, significantly in creating user-friendly good contract wallets, are set to revolutionize how customers conduct on-chain actions.

Learn extra: What’s Account Abstraction?

With intense competitors amongst pockets suppliers, fast developments on this space are anticipated. Lastly, the crypto neighborhood and builders consider that account abstraction can pave the way in which for the following billion customers to affix the Web3 sector.

Disclaimer

All the knowledge contained on our web site is printed in good religion and for common data functions solely. Any motion the reader takes upon the knowledge discovered on our web site is strictly at their very own threat.