Within the days main as much as the Bitcoin halving, the cryptocurrency market has skilled a big downturn, elevating considerations a couple of potential bear market.

Bitcoin noticed a notable 19% value drop, whereas altcoins confronted even steeper declines, with some plummeting by as a lot as 70%. This pattern has sparked a debate amongst buyers in regards to the instant way forward for cryptocurrencies because the halving approaches.

Bitcoin and Altcoins Nosedive Earlier than the Halving

Traditionally, the Bitcoin halving — a scheduled discount within the reward for mining new blocks — has been a catalyst for bullish market sentiment. The occasion successfully slashes the provision of latest BTC, which in idea ought to enhance the worth if demand stays fixed.

Nevertheless, Garry Kabankin, Market Analyst at Santiment, informed BeInCrypto that the market doesn’t function solely on fundamentals, notably in intervals surrounding such important occasions. The current value corrections in Bitcoin and altcoins could mirror a pure market response to speculative anticipation, somewhat than elementary declines in worth.

Certainly, the present market state of affairs displays a speculative buying and selling surroundings main as much as the halving.

“The steep drop in altcoins, much more so than Bitcoin, underscores the heightened volatility and speculative buying and selling that may precede such occasions. It’s a reminder of the market’s sensitivity to provide dynamics adjustments, the place the lowered block reward post-halving can result in expectations of decreased provide strain,” Kabankin defined.

Kabankin explains that observing miner conduct, akin to adjustments in miners’ stability and complete provide, can present additional insights. A lower in miners promoting their holdings pre-halving might counsel a bullish outlook, anticipating larger costs post-event.

However, the true impression of the halving will solely grow to be clear within the weeks following. Because the market adjusts to the brand new provide fee, its implications for Bitcoin’s shortage and worth will be understood.

Learn extra: Bitcoin Value Prediction 2024 / 2025 / 2030

The continuing downturn is considerably typical of the cyclical nature noticed round previous halvings. Basically, anticipation results in speculative runs adopted by corrections. Nevertheless, Kabankin factors out that given the present on-chain metrics and social sentiment, a nuanced view is critical.

“Traditionally, we’ve seen euphoria round halvings, typically resulting in a reevaluation of positions post-event. It’s essential to observe social sentiment and whale conduct for extra instant indicators of market directio,” Kabankin added.

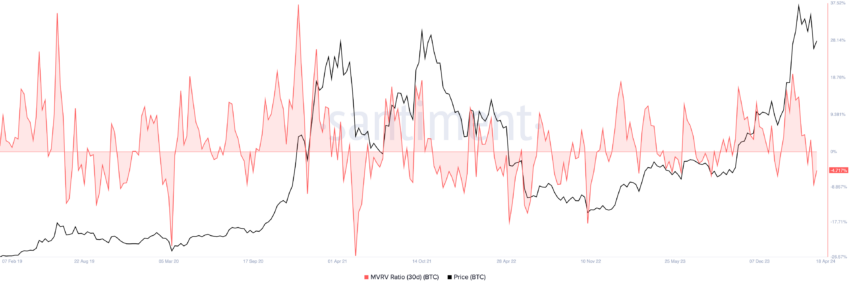

Furthermore, the Market-Worth-to-Realized-Worth (MVRV) ratio affords a transparent view of market sentiment. It signifies whether or not the asset is over or undervalued at any given time. Based on Kabankin, buyers must also carefully monitor the imply coin age. Vital drops can sign elevated motion and potential promoting strain, hinting at broader market shifts.

These indicators, mixed with conventional assist ranges from technical evaluation, can information buyers via unsure occasions.

Kabankin believes that to identify the potential resumption of a bull run, buyers ought to take note of a mix of social sentiment and on-chain metrics. A lower in concern, uncertainty, and doubt (FUD) coupled with a rise in concern of lacking out (FOMO), typically precedes market upswings.

Moreover, a big uptick in stablecoin provide transferring onto exchanges can sign readiness for purchasing motion, hinting at bullish sentiment. Additionally, a rise in buying and selling quantity can point out rising assist for the pattern. It could counsel a more healthy buildup to a bull run.

“ resistance limitations and on-chain alerts is essential for recognizing potential turnarounds. One key metric to observe is the Imply Greenback Invested Age, particularly when it begins lowering, which might point out that beforehand dormant tokens are transferring, suggesting a possible shift in market sentiment,” Kabankin emphasised.

Because the crypto market stays notoriously unstable, these indicators are very important for predicting its subsequent strikes. The historic sample post-Bitcoin halving has typically ignited altcoin seasons. It is a direct results of buyers trying to find larger returns past the preliminary surge in Bitcoin. With current dynamics and on-chain actions suggesting a buildup, one other cycle could be on the horizon.

Learn extra: What Occurred on the Final Bitcoin Halving? Predictions for 2024

The joy round altcoins, as indicated by social metrics and buying and selling volumes, factors to a rising urge for food amongst buyers. Nevertheless, it’s essential to observe these traits carefully, as fast shifts can happen within the cryptocurrency markets.

Disclaimer

Following the Belief Mission pointers, this characteristic article presents opinions and views from business specialists or people. BeInCrypto is devoted to clear reporting, however the views expressed on this article don’t essentially mirror these of BeInCrypto or its workers. Readers ought to confirm data independently and seek the advice of with an expert earlier than making choices primarily based on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.