The cryptocurrency market is buzzing with exercise as traders, establishments, and crypto holders put together for the upcoming U.S. Election & Fed Choices. On this article, we’ll break down the important thing drivers behind the present crypto panorama, why institutional investments are climbing, and the way world adoption of digital belongings is increasing.

We’ll talk about Bitcoin’s value actions, Solana’s progress, Federal Reserve insurance policies, and the distinctive components influencing cryptocurrency holders’ views. Let’s dive in!

Bitcoin Accumulation Grows Forward of the U.S. Presidential Election

Historic Election Affect on Bitcoin

Traditionally, U.S. presidential elections have impacted Bitcoin’s worth, typically spurring notable value rises post-election. CNBC has just lately reported that traders are stacking up on Bitcoin in anticipation, pushed by the assumption that political adjustments within the U.S. might set off one other wave of crypto adoption.

Supply | Anadolu Ajansi

Because the 2024 election approaches, many crypto fans are speculating on the candidates’ stances towards digital currencies. In line with a CBS Information survey, 73% of cryptocurrency holders are contemplating candidates’ stances on crypto when voting. This reveals the rising affect of cryptocurrency insurance policies in shaping political decisions, underscoring the significance of this election for the crypto sector.

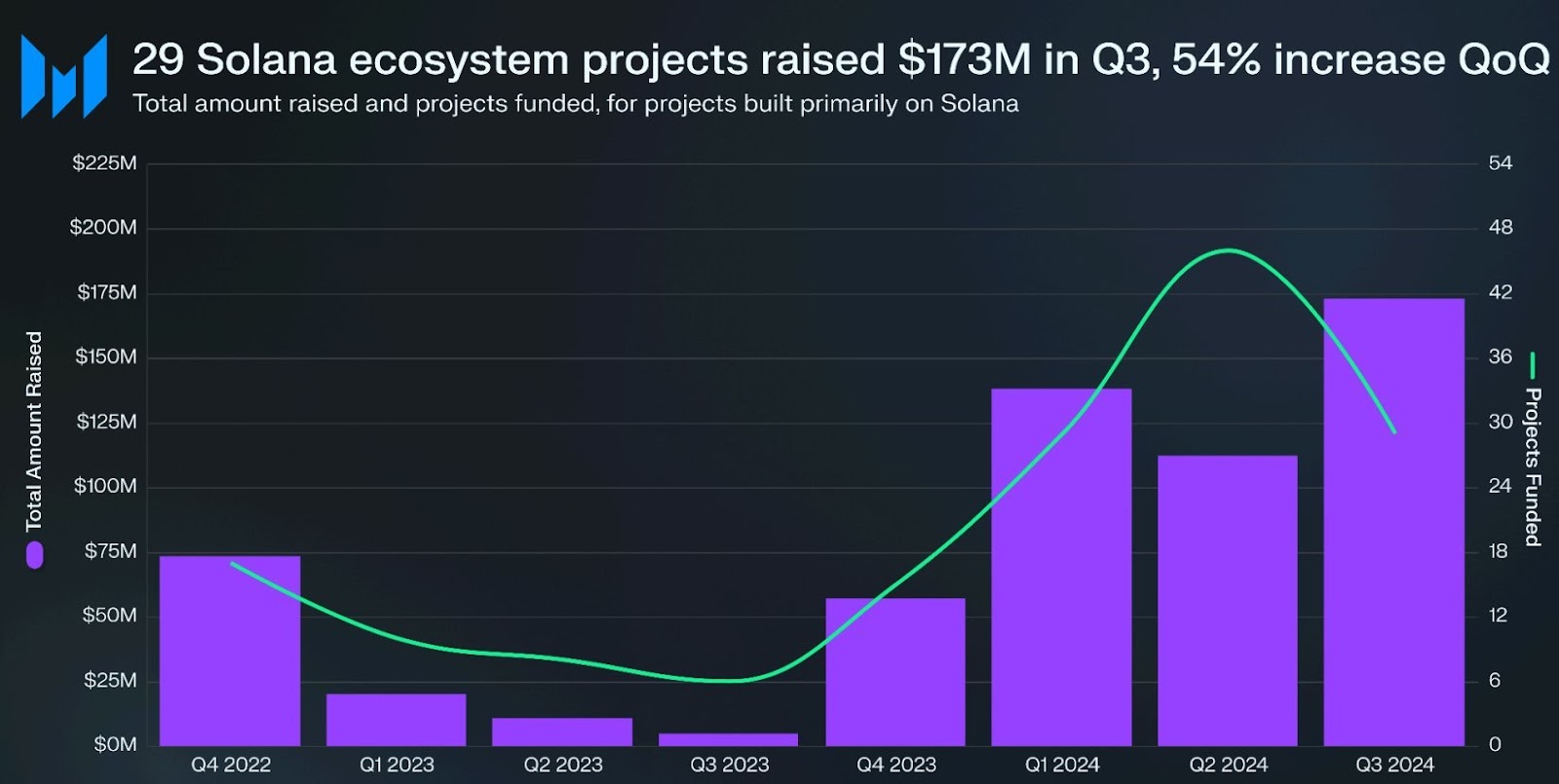

Institutional Investments in Solana Surge by 54%

Why Solana?

Institutional traders are displaying growing curiosity in decentralized purposes on Solana, with investments rising by 54% within the third quarter, reaching $173 million. This progress displays Solana’s attraction as a quick, scalable blockchain platform ultimate for decentralized finance (DeFi) purposes, non-fungible tokens (NFTs), and different rising digital belongings.

Supply | Messari.io

Why are establishments betting massive on Solana? Listed below are a couple of causes:

- Excessive Pace and Low Prices: Solana’s community helps hundreds of transactions per second at very low prices, attracting DeFi builders and customers.

- Increasing Ecosystem: Solana’s ecosystem has quickly grown, with a spread of initiatives now operating on its platform, enhancing its utility and attraction.

The latest surge in institutional investments suggests a powerful perception in Solana’s long-term potential. As establishments improve their involvement, Solana is solidifying its place as a high competitor to different blockchain giants like Ethereum.

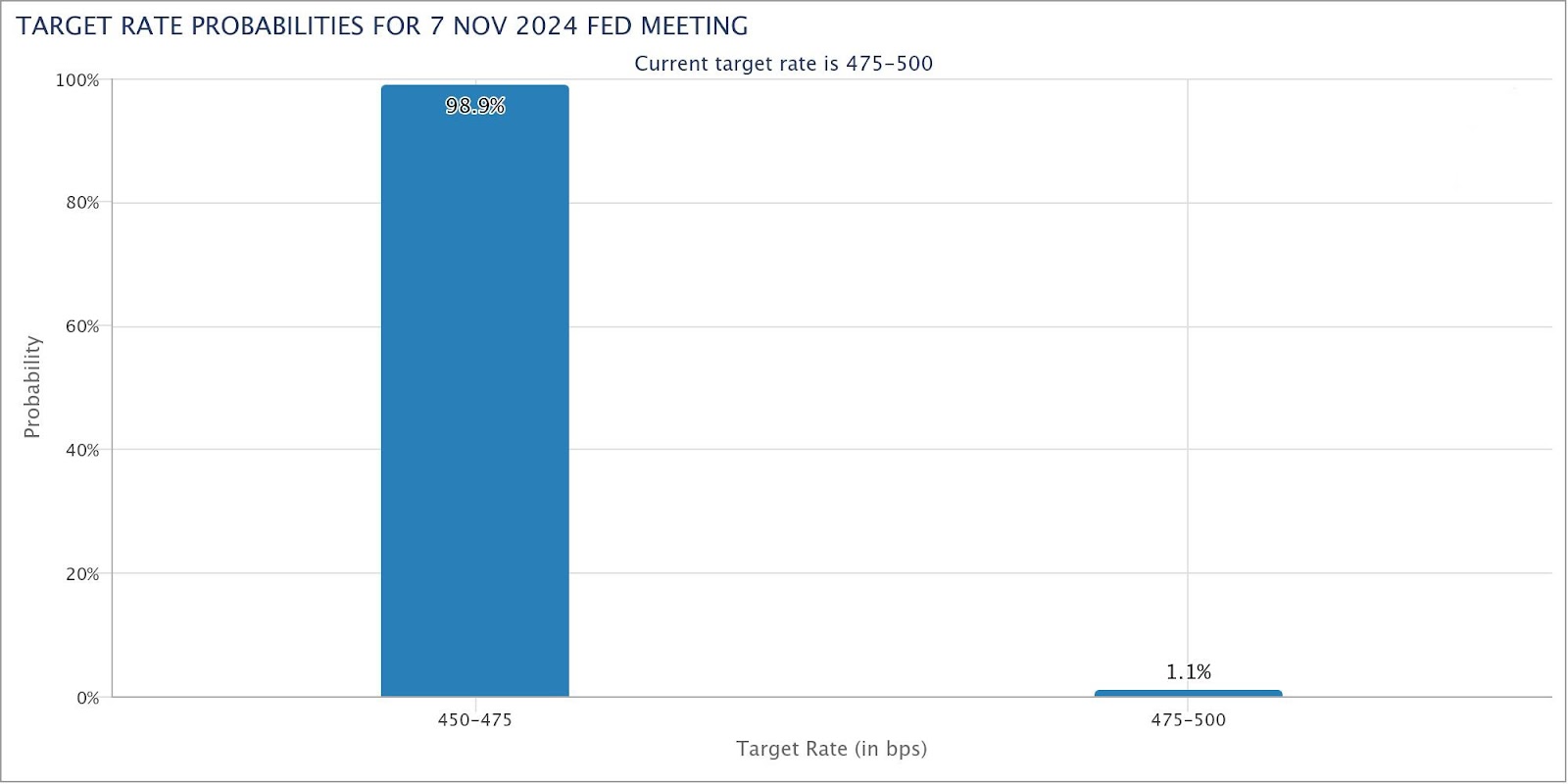

Federal Reserve Fee Cuts Might Increase Bitcoin Costs

CME FedWatch Instrument Information

Supply | Fedwatch

Traders are carefully monitoring the Federal Reserve’s upcoming determination, because the CME FedWatch Instrument reveals a 98.9% likelihood of a 25 foundation level fee reduce in November. Previous Fed fee cuts have typically led to Bitcoin value jumps, making this determination essential for crypto markets.

Historic Context: Fee Cuts and Bitcoin Costs

The final time the Fed reduce charges by 50 foundation factors, Bitcoin noticed a major value surge. If historical past repeats, this new fee reduce might set off comparable constructive actions in Bitcoin’s value. Decrease rates of interest sometimes scale back the attraction of conventional investments, driving extra traders in the direction of different belongings like Bitcoin.

Supply | Tradingview

Financial Outlook and the Fed’s Path Ahead

Economists predict that by the tip of 2024, Fed charges will in all probability drop to 4.25-4.50%, with additional reductions anticipated in 2025. This easing cycle, fueled by a weak jobs report and rising unemployment, hints at continued help for Bitcoin, as decrease charges would possibly increase different asset demand.

World Crypto Developments and Adoption

Deutsche Telekom/T-Cellular Begins Mining Bitcoin

In a pioneering transfer, Deutsche Telekom, T-Cellular’s mother or father firm, has began mining Bitcoin utilizing surplus renewable vitality. This German telecommunications large can also be working Bitcoin mining nodes, demonstrating a dedication to sustainable crypto mining practices.

Supply | Bitcoinist

This step might result in better acceptance of Bitcoin mining throughout the European Union and encourage extra firms to discover eco-friendly mining options. As a big company adopts Bitcoin mining, it indicators the potential for widespread institutional involvement in sustainable cryptocurrency practices.

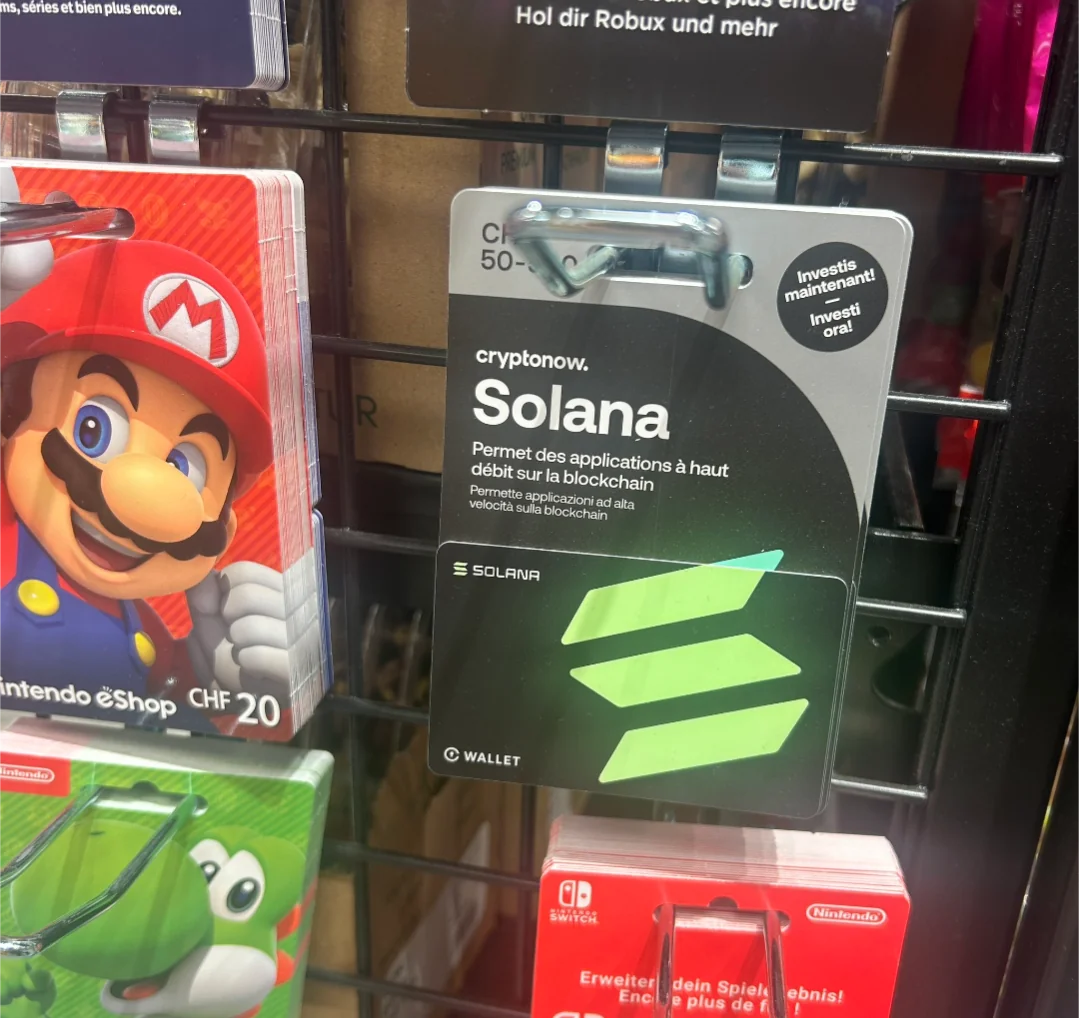

Solana Now Obtainable in Swiss Retail Shops

Supply | reddit

In Switzerland, customers can now purchase Solana immediately from supermarkets and retail shops, increasing entry to cryptocurrency for on a regular basis consumers. This ease of entry might function a mannequin for different nations, illustrating how digital belongings have gotten extra accessible to most people and reflecting the rising mainstream acceptance of cryptocurrencies globally.

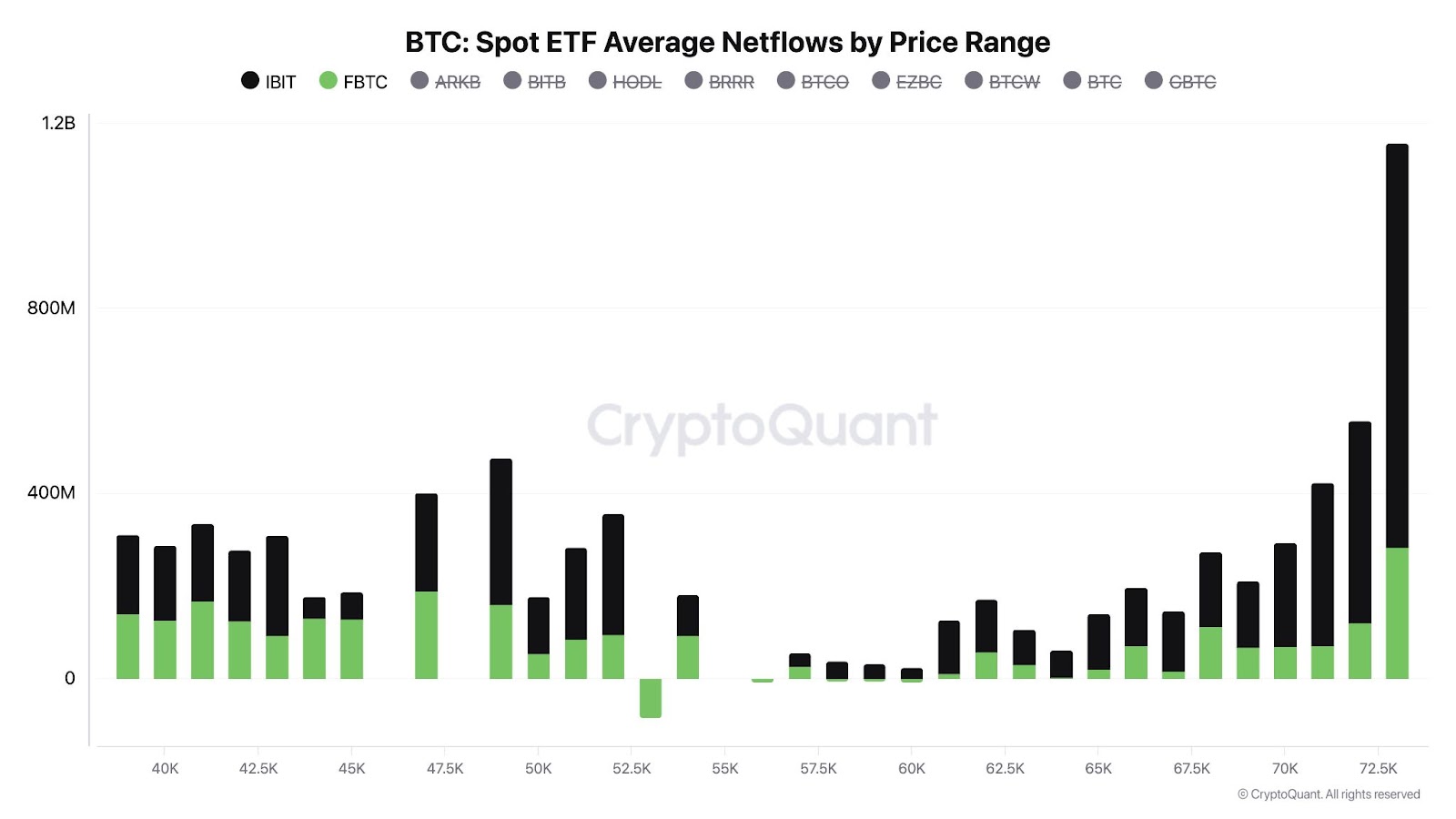

BlackRock’s Elevated Bitcoin Investments Present Institutional Confidence

File Inflows to Bitcoin Market

In latest weeks, BlackRock’s Bitcoin fund (IBIT) noticed its highest constructive weekly influx since March 2024, with $2.11 billion flowing in. This means a resurgence in institutional curiosity in Bitcoin, whilst market situations fluctuate. BlackRock’s funding reaffirms a rising pattern: giant monetary establishments are backing Bitcoin as a dependable asset.

Supply | Cryptoquant

Constructive Momentum for Bitcoin

With constant inflows from main gamers like BlackRock, Bitcoin might see sustained momentum, supporting its progress even throughout unsure market situations. For retail traders, the actions of huge institutional gamers supply helpful perception. As they are saying, “Observe their actions, not their phrases.”

Bitcoin “Whales” Accumulate Regardless of Market Dip

Whale Accumulation Patterns

Amidst concern and uncertainty following a dip under $70,000, giant Bitcoin traders (or “whales”) are quietly accumulating. Sourcing from Arkham Intel, Since November 1, 5 whales have gathered about 2,780 BTC, totaling roughly $192.4 million. These whales withdrew vital quantities from exchanges, indicating a bullish outlook on Bitcoin’s long-term potential.

Detailed Whale Transactions

- Whale 1: Withdrew 880 BTC (price roughly $61.18 million) at $69,519, now holding a complete of 1,381 BTC.

- Whale 2: Withdrew 615 BTC at $67,764, price $41.7 million.

- Whale 3: Withdrew 595 BTC at $69,587, price $41.38 million.

- Whale 4: Withdrew 550 BTC at $70,328, price $38.68 million.

- Whale 5: Withdrew 140 BTC at $67,764, price $9.48 million.

These substantial purchases recommend that whales are making the most of the value dip to bolster their holdings, underscoring their perception in Bitcoin’s long-term worth.

U.S. Presidential Election Provides a New Dimension to Crypto Market Uncertainty

Crypto’s Function within the Election

The 2024 U.S. presidential election might be the most crypto-influenced but. Notably, Trump’s pro-crypto stance has resonated with elements of the crypto group, who hope his insurance policies might result in elevated adoption of stablecoins in commerce and, probably, diminished regulatory scrutiny on crypto belongings.

Trump’s Affect on Bitcoin and Memecoins

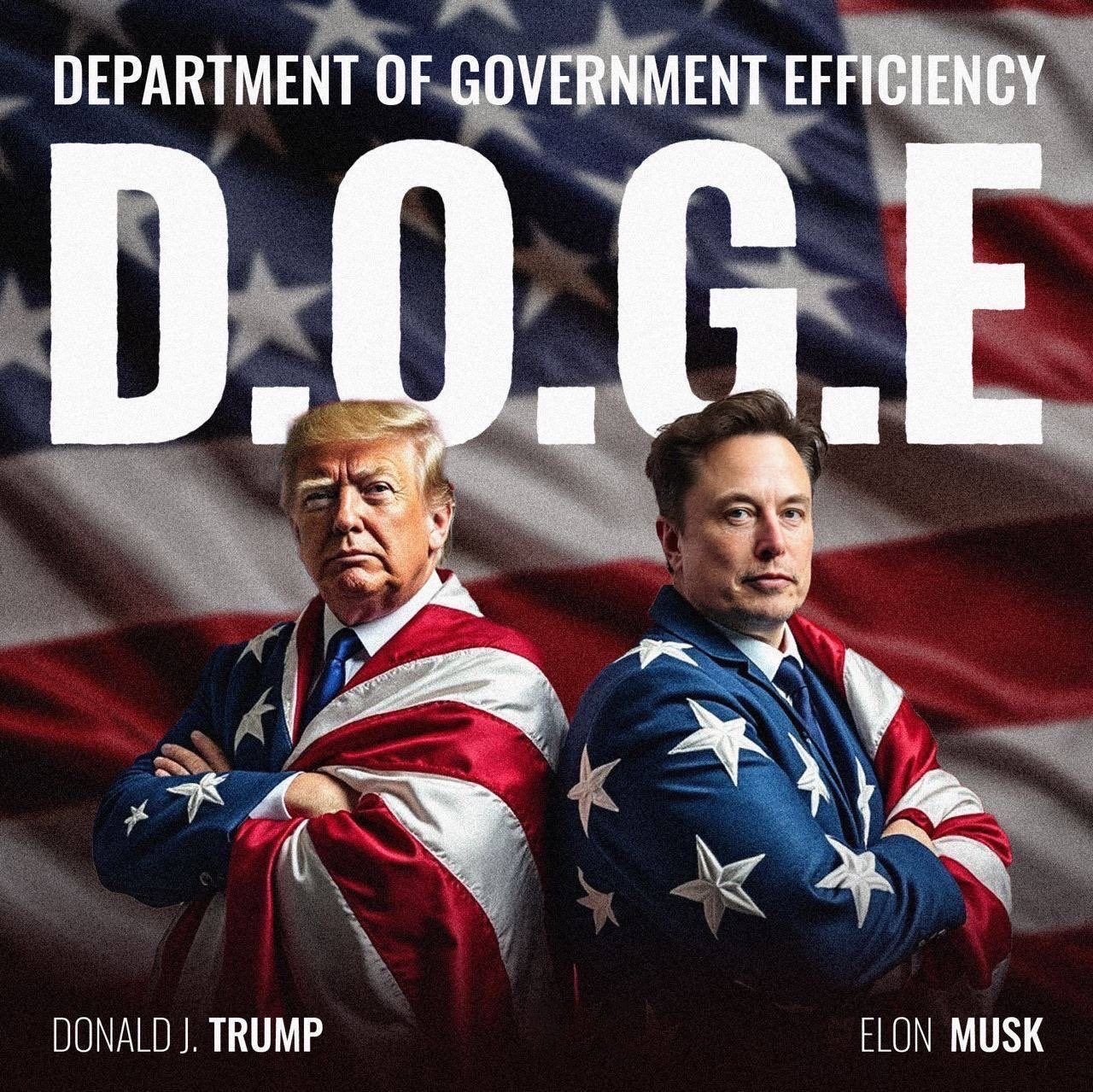

Some analysts imagine {that a} Trump victory might push Bitcoin’s value over $80,000, with memecoins like Dogecoin probably experiencing excessive volatility attributable to Trump’s endorsement of crypto-friendly insurance policies and Elon Musk’s proposed Department Of Government Efficiency, D.O.G.E.

Supply | X @cb_doge

Moreover, a number of crypto traders, together with Mark Cuban, though a Democrat, advocates for changing SEC chair Gary Gensler, aligning with Trump’s proposed regulatory adjustments. As some say “the election race stays a statistical tie”, the stakes are excessive for crypto holders eyeing regulatory shifts.

Conclusion

The cryptocurrency market is going through an array of influences, from the upcoming U.S. presidential election and Fed selections to main institutional investments in belongings like Solana and Bitcoin. For each institutional and retail traders, understanding these components can present helpful insights into potential market shifts.

Key Takeaways:

- U.S. Presidential Election: Cryptocurrency stances of candidates might have an effect on regulatory approaches, with Trump’s potential pro-crypto insurance policies being a focus.

- Federal Reserve Fee Cuts: Anticipated cuts might drive additional Bitcoin investments as conventional belongings yield decrease returns.

- Institutional Confidence: Investments in Bitcoin and Solana underscore a perception in crypto’s endurance, whereas Deutsche Telekom’s mining initiative highlights sustainable practices.

- World Accessibility: The provision of Solana in retail shops exemplifies rising mainstream adoption.

Whether or not you’re a seasoned investor or a crypto newcomer, staying knowledgeable and doing your individual analysis (DYOR) about these developments is essential as we method a pivotal interval in cryptocurrency’s evolution. This text will not be monetary recommendation—all the time DYOR! You can begin your journey with us at weblog.millionero.com, the place we share insights to assist information your analysis. And solely then, if you happen to’re able to commerce and have executed your homework, think about buying and selling spot and futures with us on Millionero.