Bitcoin closed the previous week round $63,000 and begins a brand new week within the constructive. Let’s study the long run outlook for BTC worth collectively.

Bitcoin State of affairs (BTC)

The Bitcoin worth continued its upward motion to achieve the psychological threshold of $60,000. At this degree, it started a section of consolidation by forming a symmetrical triangle, which was subsequently damaged upwards, propelling Bitcoin straight in the direction of $68,800, simply $200 shy of its all-time excessive. Concurrently, Bitcoin’s market capitalization surpassed its earlier report, reaching $1,350 billion. For comparability, the market capitalization of META (previously Fb) stands at $1,270 billion as of the publishing date of this text. Reaching such a excessive market capitalization, together with a worth nearing its all-time excessive (ATH) earlier than the halving, is a primary for Bitcoin.

Though BTC has skilled a slight market decline, bringing it under $66,000, its total pattern stays bullish. You will need to be aware that Bitcoin’s worth has distanced itself from its 50-day shifting common, indicating a interval of excessive volatility that might be corrected quickly. Relating to market dynamics, it’s not stunning that they’re perceived as constructive. That is significantly evident from the oscillators, which even counsel that an overbought interval is perhaps underway.

The present technical evaluation has been carried out in collaboration with Elie FT, an investor and dealer passionate concerning the cryptocurrency market. In the present day, he’s a coach at Household Trading, a group of 1000’s of proprietary merchants energetic since 2017. There you’ll discover Lives, instructional content material, and assist round monetary markets in an expert and pleasant environment.

Give attention to Derivatives (BTCUSDT)

We will observe that the open curiosity of BTC/USDT perpetual contracts has elevated alongside its worth, accompanied by a constructive funding price and predominantly vendor liquidations. All these parts counsel that merchants’ speculative curiosity is principally oriented in the direction of shopping for. Nevertheless, it is very important emphasize that the funding price is considerably constructive, suggesting that the worth of the perpetual BTC/USDT contract is greater than the BTC spot market worth. This hole could replicate elevated optimism within the derivatives market. As constructive as this will appear, a too excessive funding price over an prolonged interval also can point out that the market is in an overbought section. Thus, a rebalancing is fascinating for a wholesome continuation of the pattern.

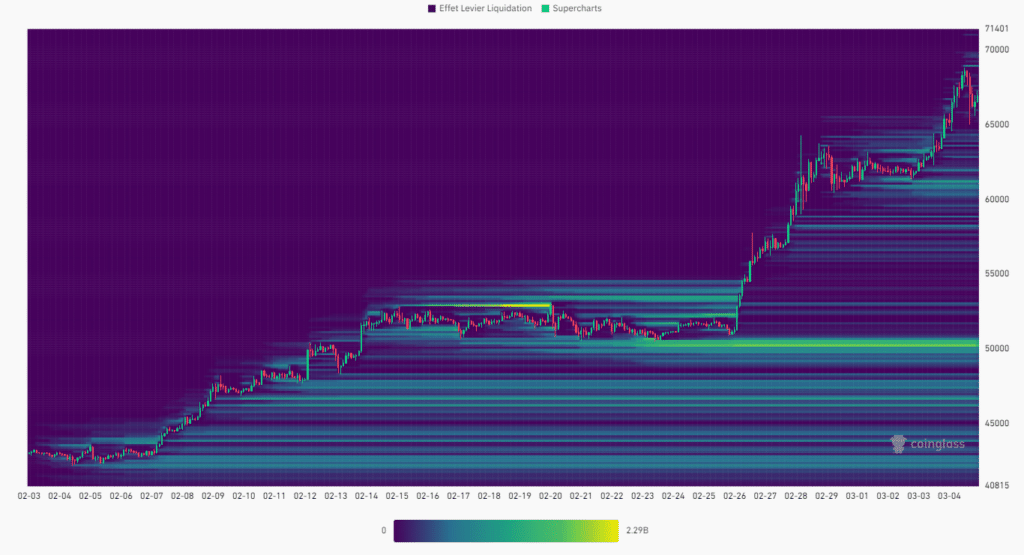

The liquidation heatmap for BTC/USD presently signifies that the closest liquidation zones to the present worth are under it. Notably, the $61,000 degree, after which, at an excellent decrease degree, the $50,000 threshold, which is especially important. Because the market approaches these ranges, we might witness a large triggering of orders, probably rising the volatility of the cryptocurrency. These zones subsequently symbolize main factors of curiosity for traders.

Potential Eventualities for Bitcoin Worth (BTC)

- If Bitcoin worth manages to carry above $60,000, we might envisage one other rise to its ATH, that’s round $69,000. Past that, the following resistance could be theoretical, however through the use of Fibonacci extensions, the $80,000 degree might be thought of as similar to the 100% extension. If the bullish pattern continues, ranges of $95,000 and even the symbolic threshold of $100,000 might be in sight. Reaching the latter would mark a rise of about +50%.

- If Bitcoin worth fails to take care of above $60,000, we might anticipate purchaser curiosity assist from the zone round $58,000 or $57,000. The subsequent degree to think about if the bearish motion continues could be round $52,000. At this level, it could symbolize a drop near -22%.

Conclusion

Bitcoin has reached a report capitalization and is now just a few {dollars} off its all-time excessive (ATH). Though there isn’t any indication that Bitcoin’s momentum will cease, it is very important be aware {that a} correction might legitimately be thought of after such volatility and at this worth degree. Thus, it will likely be essential to intently observe the worth’s response to completely different key ranges to verify or invalidate the present hypotheses. Additionally it is necessary to remain vigilant towards potential “pretend outs” and market “squeezes” in every state of affairs. Lastly, let’s do not forget that these analyses are primarily based solely on technical standards and that cryptocurrency costs may evolve shortly primarily based on different extra elementary elements.

Maximize your Cointribune expertise with our ‘Learn to Earn’ program! Earn factors for every article you learn and achieve entry to unique rewards. Join now and begin accruing advantages.

Household Buying and selling est une Communauté de merchants a compte propre energetic depuis 2017 offrant Lives, contenus éducatifs et entraides autour des marchés financiers dont celui des cryptomonnaies avec à ses côtés Elie FT, investisseur et dealer de ardour sur le marché crypto.

Disclaimer:

The contents and merchandise talked about on this web page are by no means endorsed by Cointribune and shouldn’t be construed as its accountability.

Cointribune strives to supply readers with all related data out there, however can’t assure its accuracy or completeness. Readers are urged to make their very own inquiries earlier than taking any motion with respect to the corporate, and to imagine full accountability for his or her choices. This text doesn’t represent funding recommendation or a suggestion or invitation to buy any services or products.

Investing in digital monetary belongings entails dangers.

Learn extra