Bitcoin rebounds after beginning April on a downturn. Let’s analyze the long run prospects for the BTC value collectively.

Bitcoin (BTC) State of affairs

Whereas Bitcoin confronted promoting stress within the early days of April, the main cryptocurrency’s value has recovered after hitting a brand new low at $64,500. Certainly, it reached $72,000 this Monday. This value degree appears to have acted as resistance, with BTC struggling to surpass it. In truth, this Tuesday morning, the Bitcoin value fell again beneath the earlier resistance degree recognized at $71,270. On the time of writing, Bitcoin is buying and selling round $70,000.

Bitcoin is holding barely above the worth zone situated round $69,800, which might function help. Total, Bitcoin’s pattern stays bullish, as evidenced by the 50 and 200-day shifting averages. Concerning market dynamics, a slight rebound is noticed, although it’s not but vital, as indicated by the oscillators. This phenomenon might show dangerous in the long run.

The present technical evaluation has been carried out in collaboration with Elie FT, an investor and passionate dealer within the cryptocurrency market. Now a coach with Household Buying and selling, a group of 1000’s of proprietary merchants lively since 2017. You can see reside periods, academic content material, and peer help round monetary markets in knowledgeable and heat ambiance.

Concentrate on Derivatives (BTCUSDT)

The open curiosity in BTC/USDT contracts has adopted the course of its value. Certainly, we will see that they elevated earlier than barely reducing this Tuesday, April ninth within the morning. It’s fascinating to notice that almost all of the liquidations have lately been of brief positions. Coupled with a delicate enhance within the funding price, this means that the curiosity in Bitcoin perpetual contracts has lately been predominantly on the purchase facet.

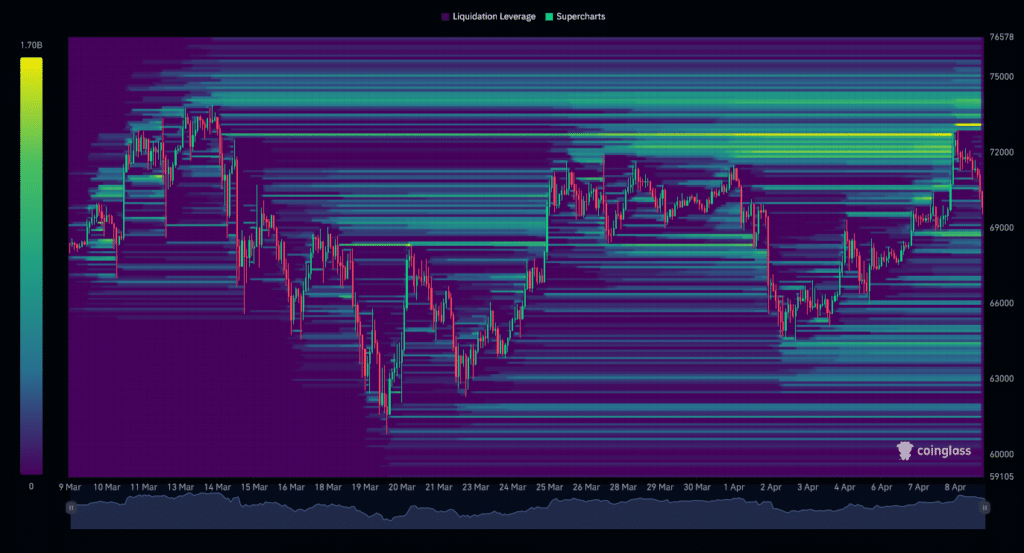

The liquidation warmth map of the previous month signifies that BTC/USDT has gone by a big liquidation space, situated round $72,000. Presently, the Bitcoin value appears to point out promoting curiosity at this degree, marking a slight distribution part. At current, probably the most vital liquidation zone above the present value is in a value vary between $73,000 and $75,000. Under the present value, the notable ranges are $69,000 and additional down, $64,500. If the market approaches these ranges, we might witness an enormous triggering of orders, probably rising the cryptocurrency’s volatility. These zones, subsequently, characterize a serious focal point for buyers.

Hypotheses for the Bitcoin (BTC) Value

- If the Bitcoin value manages to carry above $69,000, we might anticipate a bullish continuation as much as the $73,000 degree. The subsequent resistance to contemplate, if the bullish motion continues, can be $74,000 and even $75,000 and past. At this level, it will characterize a rise of over 7%.

- If the Bitcoin value fails to carry above $69,000, we would anticipate purchaser help round $67,000. The subsequent degree to contemplate, if the bearish motion continues, can be in a value vary round $64,000 and $63,000. At that stage, it will characterize a drop of almost -9%.

Conclusion

Within the face of early April’s turbulence, Bitcoin reveals a bullish pattern supported by indicators of resilience above key help ranges. Regardless of the speedy challenges, it appears possible that patrons predominate the market. Nonetheless, will probably be essential to carefully observe the value response at totally different key ranges to substantiate or invalidate the present hypotheses. It is usually necessary to stay vigilant of potential “faux outs” and market “squeezes” in every state of affairs. Lastly, let’s do not forget that these analyses are primarily based solely on technical standards and that cryptocurrency costs can evolve quickly attributable to different extra basic elements.

Maximize your Cointribune expertise with our ‘Learn to Earn’ program! Earn factors for every article you learn and achieve entry to unique rewards. Enroll now and begin accruing advantages.

Household Buying and selling est une Communauté de merchants a compte propre lively depuis 2017 offrant Lives, contenus éducatifs et entraides autour des marchés financiers dont celui des cryptomonnaies avec à ses côtés Elie FT, investisseur et dealer de ardour sur le marché crypto.

Disclaimer:

The contents and merchandise talked about on this web page are by no means endorsed by Cointribune and shouldn’t be construed as its duty.

Cointribune strives to supply readers with all related data out there, however can not assure its accuracy or completeness. Readers are urged to make their very own inquiries earlier than taking any motion with respect to the corporate, and to imagine full duty for his or her choices. This text doesn’t represent funding recommendation or a suggestion or invitation to buy any services or products.

Investing in digital monetary belongings includes dangers.

Learn extra