In a rare show of market volatility, the cryptocurrency market noticed a staggering $5.55 billion in lengthy and brief positions liquidated this April. This was primarily triggered by the mounting hypothesis across the Bitcoin halving occasion.

This tumultuous interval serves as a fertile floor for essential insights and strategic variations in funding practices.

Volatility Strikes Pre-Bitcoin Halving

Rossmarie Davila, a seasoned crypto monetary advisor, gave BeInCrypto insights into the perfect practices for navigating these turbulent occasions.

When establishing an funding portfolio, she suggests having a transparent goal for every asset on a brief and long-term foundation. Davila highlights the significance of a well-defined technique as Bitcoin’s inherent volatility calls for a nuanced method.

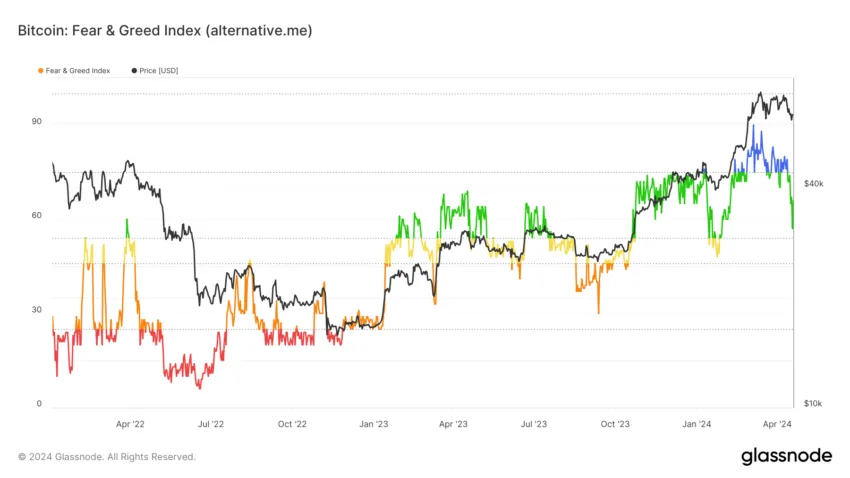

Certainly, this 12 months’s halving has already considerably influenced Bitcoin’s market, driving costs to an all-time peak of $73,737 in March. Nevertheless, the next weeks introduced volatility, with Bitcoin experiencing a pointy 20% value correction and a few altcoins plummeting by over 70%.

Given the excessive volatility, Davila strongly advises newcomers to the cryptocurrency market to proceed with warning.

“One of the best factor to do is to not panic and rush out to purchase like loopy, as a result of Bitcoin is unstable. I feel a very good recommendation is to allocate a hard and fast quantity every month and purchase on the common value, and within the meantime, see how you’re feeling about these extremely unstable investments. With a transparent technique, market noise mustn’t trigger me anxiousness,” Davila advised BeInCrypto.

Learn extra: Crypto Portfolio Administration: A Newbie’s Information

She additionally notes the psychological dynamics at play, notably post-halving. The lowered Bitcoin provide invariably results in value will increase attributable to demand — basic provide and demand dynamics. If an funding portfolio aligns with expectations, it’s recommendable to take care of one’s course.

In any other case, Davila suggests traders ought to take into account reallocating or growing holdings after value corrections, however by no means throughout peak values. You will need to do not forget that the crypto market is influenced by many exterior components and is troublesome to foretell with certainty. Nonetheless, following earlier Bitcoin halvings, value sometimes stabilizes after an preliminary surge as capital flows into altcoins.

Managing Feelings and Expectations

Addressing the influence on traders, particularly novices, Davila emphasizes the potential psychological pressure. Discount in Bitcoin provide may cause anxiousness amongst newcomers, compounded by frequent and sensational information protection. This concern of lacking out can drive ill-considered choices.

She factors out that market sentiment, as gauged by the concern and greed index, presently signifies “greed,” suggesting an overvaluation and a possible forthcoming correction. Even with the halving and the debut of spot Bitcoin exchange-traded funds (ETFs), “the analytical method ought to stay the identical,” advises Davila.

Lastly, She discusses operational ways for various funding horizons. For speculative short-term holdings, as an illustration, she believes it’s important to make the most of respected platforms with important day by day buying and selling volumes and consumer engagement. For long-term holdings, safe storage in chilly wallets is advisable.

Learn extra: High 11 Platforms To Commerce the Least expensive Cryptocurrencies

Because the dialog about cryptocurrencies continues to evolve, Davila sees Bitcoin’s utility in transactions and its broader acceptance as a reliable monetary asset solely growing, particularly as regulatory landscapes adapt.

Disclaimer

Following the Belief Challenge pointers, this function article presents opinions and views from business specialists or people. BeInCrypto is devoted to clear reporting, however the views expressed on this article don’t essentially replicate these of BeInCrypto or its employees. Readers ought to confirm data independently and seek the advice of with knowledgeable earlier than making choices primarily based on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.