The CoinDesk coverage staff is scattered all through the world; within the remaining version of this article, every member explains what they’re watching in 2024 on the planet of crypto laws. Joyful holidays, and we’ll see you subsequent 12 months!

You’re studying State of Crypto, a CoinDesk publication trying on the intersection of cryptocurrency and authorities. Click on right here to enroll in future editions.

As is now this article’s annual custom, CoinDesk’s regulation staff explains what we’re taking note of in 2024.

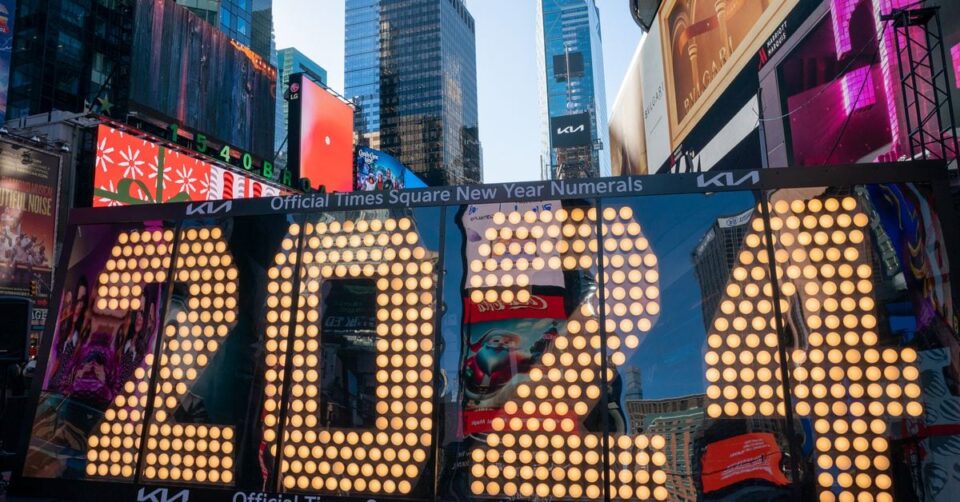

Subsequent 12 months can be busy. Crypto is having a resurgent second, and this previous 12 months’s conviction of Sam Bankman-Fried and responsible plea from Changpeng Zhao, the potential approval of a spot bitcoin exchange-traded fund and only a common upswing out there are certain to have lots of people feeling hopeful about this trade’s future. However lawmakers and regulators aren’t more likely to spend much less time on crypto points both.

Nikhilesh De: There is no relaxation for the weary. Although lots occurred in 2023, together with a complete legal trial, subsequent 12 months guarantees to be a lot busier. I am fascinated by 5 most important classes of occasions or actions that will play out subsequent 12 months: Court docket circumstances, elections, regulatory company actions, laws and the broader crypto market.

Clearly the U.S. Securities and Alternate Fee has had a reasonably energetic 12 months, with lawsuits towards Coinbase, Kraken and Binance/Binance.US over the previous 12 months (actually the previous seven). Whereas the regulator’s case towards Ripple exhibits us that it could take some time for these circumstances to resolve, we’ll nonetheless begin seeing how the courts view the arguments being made.

The Commodity Futures Buying and selling Fee will likewise have an attention-grabbing function subsequent 12 months. CFTC Chair Rostin Behnam has mentioned on various public events that he is happy with what number of enforcement actions his company’s taken, and that is not more likely to let up subsequent 12 months.

Past that, there’s additionally the nationwide safety and legal circumstances. USA v. Avi Eisenberg, Roman Storm, Alex Mashinsky, Changpeng Zhao and even Samuel Bankman-Fried (spherical 2) will see federal prosecutors elevate some attention-grabbing authorized questions for the crypto trade.

Bankman-Fried and Zhao each have sentencing hearings arising within the first half of the brand new 12 months. Zhao is 10-18 months or so when he is sentenced in late February 2024 after pleading responsible to 1 cost of violating the Financial institution Secrecy Act as the previous CEO of Binance.

Bankman-Fried, after all, faces a for much longer sentence after a jury convicted him on seven completely different prices in early November. He additionally faces a possible second trial. We could not know for a couple of extra months whether or not the DOJ intends to proceed on the second trial, which is at present scheduled to start in early March. If prosecutors transfer ahead, Bankman-Fried’s sentencing, at present set for later in March, will in all probability be delayed.

The Eisenberg and Storm circumstances can be extra attention-grabbing, simply from the authorized theories we’ll see mentioned.

Eisenberg, who was arrested a 12 months in the past immediately, is accused of commodities manipulation and fraud after executing a “buying and selling technique” that resulted in Mango Markets dropping $114 million. His trial is at present scheduled for April.

Storm, in the meantime, faces prices of conspiracy to function a cash transmitter, facilitate cash laundering and sanctions evasion tied to his work as a developer on Twister Money, a crypto mixing service.

The bankruptcies are shifting nearer to resolutions, and we’ll proceed watching them to see what precisely these firms’ former customers will get again.

We’ll be watching (and reporting on) elections within the U.S., European Union, India, Indonesia and presumably the UK subsequent 12 months. Every of those elections can be necessary – even when the winners haven’t got specific positions on cryptocurrency points, the division or ministry heads they appoint and the legal guidelines they push for will clearly have an effect on the crypto sector.

Within the U.S., we’re as soon as once more elections at each degree of presidency, from state and native points to the Home of Representatives and Senate to the workplace of the U.S. president. Marketing campaign season is already in full swing, however inside the subsequent few weeks we’ll begin to see major candidates dwindle.

It is nonetheless not clear to me that crypto will actually be a problem for lawmakers within the U.S. past being generic speaking factors however we’ll see.

No main crypto laws superior out of Congress this 12 months, although stablecoin and market construction payments made extra progress than any earlier laws. We’ll probably see these payments proceed to be mentioned this upcoming 12 months, although after all the election can be a serious wrinkle.

The folks to look at are Congressman Patrick McHenry (R-N.C.), the Home Monetary Companies Chair who’s not operating for reelection; Congresswoman Maxine Waters (D-Calif.), the Home Monetary Companies Rating Member; Senator Sherrod Brown (D-Ohio) the Senate Banking Committee Chair, who’s operating for reelection; and Senator Tim Scott (R-S.C.), who briefly ran for president.

McHenry has already advised Politico he intends to push ahead with crypto laws throughout his remaining time period. Nonetheless, he is up towards a clock: Sooner or later, Congress goes to be extra centered on elections and campaigning than on their work in D.C.

Equally, we’ll see if federal regulators interact in additional rulemaking, in addition to which excellent proposed guidelines they undertake.

After all, we will not ignore the truth that costs are up, individuals are reserving paper returns (and a few precise returns) and that there is plenty of pleasure round. Whether or not issues are completely different this time by way of resilient platforms or market constructions, and whether or not individuals are higher protected towards dropping billions of {dollars}, will each have an effect on how regulators worldwide have a look at this trade.

This time final 12 months, I predicted that questions on consumer information on bankrupt platforms will get extra airtime; that the SEC would take extra actions, that I would not count on a lot by way of laws and that regulators would have a response to 2022’s collapse. I feel a few of these predictions held up fairly nicely: The SEC sued various exchanges and laws superior out of committee however has but to clear any main physique of Congress. I do not suppose sufficient time has handed for us to obviously see the regulatory response to the collapse of FTX and different firms, however lawmakers are clearly fascinated about these points.

Sandali Handagama (EMEA): In my heads-up for 2023, I mentioned we’d hear fairly a bit about international norms for crypto. Effectively, the watchdogs actually got here by way of – and with gusto.

Living proof: crypto’s theoretically much less unstable subset, stablecoins, are getting some global-level powerful love. Worldwide securities regulator IOSCO in its coverage suggestions rejected trade pleas for stablecoins to obtain particular remedy. Banking regulator BCBS adopted that up with plans to tighten necessities for stablecoins to qualify as safer property for financial institution exposures. We’ll see much more tweaking or introducing of recent requirements for crypto and stablecoins subsequent 12 months.

If 2023 was the 12 months of crypto regulation, 2024 will see a few of these guidelines in motion. The European Union’s landmark Markets in Crypto Belongings (MiCA) regulation is about to come back into impact subsequent December after its finalization this 12 months. In 2024, firms and EU member states will race to change into MiCA compliant. As my former colleague Jack Schickler predicted, firms have certainly been taking part in some hopscotch, making an attempt to select the perfect EU nation to quiet down in time for the principles.

I’ll even be watching the EU’s parliamentary elections in 2024. Though MiCA’s by way of, there are a lot extra related frameworks within the making, together with one for the metaverse and one other for a digital euro.

We’ll get a greater really feel for contemporary 2023 regulatory regimes in aspiring crypto hubs Dubai and Hong Kong. We’re additionally anticipating extra laws from a number of jurisdictions together with Turkey and South Korea.

Let’s simply say that, going into a brand new 12 months and a brand new bull run, regulators worldwide have tried to ensure to be in a greater place to inform crypto how one can keep in line. However my most assured prediction is that campaigning by central banks and standard-setters to persuade the plenty that central financial institution digital currencies (CBDC) are higher for funds than personal crypto will proceed into subsequent 12 months. Secure guess.

Jesse Hamilton (U.S.): From the vantage level of Washington, D.C., my predictions for crypto’s 2024 can be wholly unsatisfying for these eagerly awaiting progress.

The most effective the trade can probably count on is a few decision in its court docket clashes with the Securities and Alternate Fee (SEC), although the company might be going to hammer the sector with focused new coverage. We even have a robust likelihood of seeing a crypto laws surge set a brand new high-water mark in 2024, with passage within the Home of Representatives of some digital property regulation.

Take my predictions this 12 months with some warning, although, as a result of final 12 months I would prompt the “future might be determined” in 2023 on whether or not crypto may transfer ahead within the U.S. as a widespread, generally exchanged asset. The truth is, nothing a lot was determined — besides that the SEC is not at all times proper, in response to federal judges in a number of circumstances.

Although I would predicted that Congress would in all probability take months to “discover widespread floor on crypto,” that floor was by no means situated on the Senate facet. A prediction about 2023 would have been higher to have learn: Count on coverage chaos, authorized clashes, large enforcement actions and a small quantity of legislative progress.

Whereas an outgoing Rep. Patrick McHenry (R-N.C.), the chairman of the Home Monetary Companies Committee, could discover a approach to set his crypto legacy by successful Home passage for crypto stablecoin regulation, the Senate has been reluctant about doing enterprise on digital property payments. Anyone who can see into the guts of Sen. Sherrod Brown (D-Ohio), the chairman of the Senate Banking Committee, and browse his crypto intentions, please let me know.

Whereas sideshows just like the central financial institution digital forex (CBDC) debate proceed, probably the most impactful coverage strikes from the U.S. authorities might be in finalization of actually consequential guidelines from the SEC and the Inner Income Companies that might particularly regulate facets of the U.S. trade for the primary time. A couple of of those initiatives spell devastation for decentralized finance (DeFi) in the event that they emerge as they have been proposed.

As 2024 looms, the trade is discovering it extra nice to concentrate on the probability of a spot bitcoin exchange-traded fund (ETF) getting an SEC nod. However the SEC has a number of crypto guidelines loosely focused for April, in response to its agenda, together with one that might broaden the definition of exchanges to incorporate crypto platforms and one other that might order funding advisers to maintain their prospects’ crypto property with “certified custodians” — not the present vary of trade exchanges, in response to SEC chief Gary Gensler. (Although these guidelines may finally be challenged in court docket, identical to the whole lot else.)

The takeaway: If you happen to loved 2023 (sicko!), you may in all probability actually like 2024.

Amitoj Singh (India): The world’s largest democracy goes to elections subsequent 12 months and by June 2024, primarily based on present state election traits and polls, Narendra Modi will return as India’s Prime Minister for a 3rd time period. With it, the identical insurance policies represented by his celebration, the Bharatiya Janta Celebration, are more likely to be retained. That may imply India’s controversial and stiff crypto taxation coverage could not see a change in 2024. A suppose tank research helps lowering the taxes – a 30% tax on crypto income and a 1% tax deducted at supply (TDS) on all transactions. The crypto trade has advocated for modifications too. However Modi’s authorities hasn’t given any indication of wanting to vary that coverage. As for a crypto or Web3-specific legislative invoice, Jayant Sinha, one in every of India’s senior lawmakers from Modi’s celebration overseeing the monetary evolution of the nation, has already mentioned that received’t occur anytime quickly and maybe not till mid-2025. Because of this, in 2024, India’s crypto fanatics could not have a lot hope for a discount in taxation insurance policies, however they are going to be looking for piecemeal measures for the Web3 and blockchain trade to be folded into the nation’s additional push towards digitizing its future. Modi’s authorities has already made encouraging steps for the house whereas sustaining a separate stiff coverage for crypto property. I’ll be keeping track of two separate price range shows in India’s parliament, one earlier than the election and one after, to see if India’s prioritization of framing a crypto framework for the globe because the president of the Group of 20 (G20) nations in 2023, turns into its personal home legislative precedence. As prompt in 2022, I watched the Modi authorities’s price range shows in 2023 and its G20 work carefully. I additionally watched whether or not the Indian central financial institution’s hopes to launch a full-scale central financial institution digital forex (CBDC) would come true. They didn’t. Nevertheless, wholesale and retail pilots have proven promising outcomes and their progress, together with considerations round privateness, perhaps the main focus of 2024.

Camomile Shumba (UK): Final 12 months I mentioned that the U.Okay. authorities wanted to offer extra readability on the way it needs to manage crypto. Now a 12 months on I can say that the federal government’s imaginative and prescient for the burgeoning sector has change into clearer.

A whole lot of laws has handed, which means the U.Okay. is shifting ahead with its plans to be a crypto hub – a need that in response to the U.Okay. authorities comes hand in hand with regulation.

The Monetary Companies and Markets Act (FSMA) – which gave regulators extra energy over the crypto sector – handed into regulation in June together with against the law invoice that can assist regulation enforcement companies seize crypto.

The FCA enforced its promotions guidelines for crypto – which meant that abroad companies couldn’t attain out to U.Okay. shoppers with out the FCA’s greenlight however this led to crypto companies leaving the nation. Corporations can be seeking to adapt to those guidelines.

The U.Okay. will proceed to battle with managing its crypto hub ambition with the FCA’s tendency to be strict. Plus, the U.Okay.’s staged strategy the place it offers with one facet of crypto at a time implies that completely different facets of the crypto market can be left in limbo till laws come out. The digital pound session outcomes are nonetheless but to come back out.

With the election more likely to happen subsequent 12 months – and Labour being a well-liked candidate – one other query on everybody’s lips is – if Labour have been to take over – what would they alter?

Elizabeth Napolitano (U.S.): The cryptocurrency trade has a busy (and seemingly brighter) 12 months forward of it. Shortly after ringing in 2024, we will count on to see the SEC approve its first swath of spot bitcoin ETFs, which may impel institutional buyers to pour massive bucks into the digital property house. Information of the approvals may fire up public curiosity in digital tokens, pushing them farther from the fringes of finance to middle stage.

Throughout the Atlantic, subsequent 12 months will even show an thrilling one for crypto. In late 2024, we’ll lastly see MiCA, the European Union’s (EU) regulatory framework for crypto, take impact. The laws successfully bans algorithmic stablecoins (suppose: DAI), which are sometimes used as collateral for borrowing and lending throughout decentralized exchanges (DEXs) similar to Curve Finance and Uniswap. This aspect of the framework will probably have second-order results on the expansion of decentralized finance (DeFi) throughout the EU’s 27 member states, stymieing Europeans’ engagement in a vastly worthwhile, if perilous, sector of the crypto trade.

Editor’s be aware: Are you looking for one thing particular subsequent 12 months on the intersection of laws, politics and crypto? Shoot me a be aware together with your identify or deal with and curiosity within the house and your be aware could seem in a future version of State of Crypto.

If you happen to’ve received ideas or questions on what I ought to talk about subsequent week or some other suggestions you’d wish to share, be at liberty to e-mail me at nik@coindesk.com or discover me on Twitter @nikhileshde.

You can too be part of the group dialog on Telegram.