At present, Ethereum ETFs made their long-awaited debut on main inventory exchanges. This text will analyze projected inflows for Ethereum ETFs and the way they could affect the longer term value of ETH. By evaluating the latest success of Bitcoin ETFs, we’ll discover the potential influence on Ethereum costs within the coming months.

Understanding Bitcoin ETF inflows and their implications for Ethereum

Whereas Bitcoin ETFs have seen substantial inflows, expectations for Ethereum ETFs are extra modest. Since their inception, Bitcoin ETFs have attracted important investor curiosity. As of July 18, these monetary devices noticed a web influx of $16.67 billion over roughly six months. Regardless of being the second-largest cryptocurrency, Ethereum is commonly perceived otherwise from Bitcoin. It’s not usually seen as a retailer of worth or “digital gold.” This distinction, mixed with Bitcoin’s extra established market place, means that Ethereum might not appeal to the identical stage of ETF inflows as Bitcoin.

Eric Balchunas, a senior ETF analyst at Bloomberg, has supplied conservative estimates for Ethereum ETF inflows and believes that these funds will appeal to solely 10-15% of the inflows seen by Bitcoin ETFs.

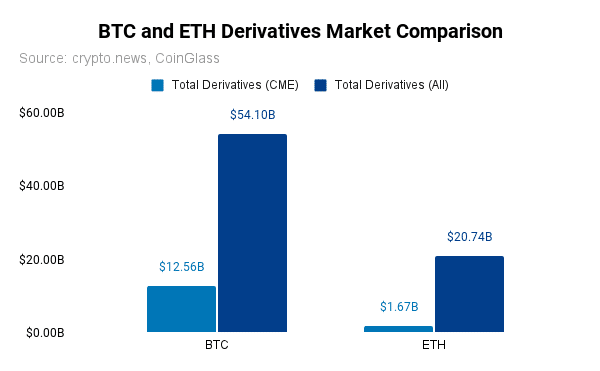

Moreover, when wanting on the derivatives market, the open curiosity for Ethereum futures and choices on the CME is roughly $1.67 billion, whereas Bitcoin’s open curiosity stands at $12.56 billion. The CME, which primarily serves institutional traders, exhibits that Ethereum’s share is about 13.3% of Bitcoin’s. Within the broader derivatives market, Ethereum’s whole open curiosity is $20.74 billion in comparison with Bitcoin’s $54.1 billion, which interprets to a 38.34% ratio. These figures reinforce the conservative projections for Ethereum ETF inflows in comparison with Bitcoin.

Tutorial insights into ETF results on market costs

A query usually arises: why would ETF inflows influence the value of an underlying asset, resembling Ethereum? A number of educational research have confirmed ETFs’ important affect on underlying asset costs. Analysis by Ben-David et al. (2018) demonstrates that ETFs can result in elevated volatility and value deviations from elementary values within the securities they monitor. The research attributes these results to the mechanical rebalancing and buying and selling methods employed by ETFs, which might amplify value actions and introduce non-fundamental shocks into the market.

Additional supporting proof comes from Luca J. Liebi’s literature assessment. The analysis highlights ETFs’ function in enhancing market liquidity and value effectivity below regular circumstances. Empirical proof means that ETFs, notably these with excessive leverage, can enlarge value adjustments in underlying property as a result of their rebalancing actions. These research collectively point out that ETF inflows are inclined to push up the costs of the property they monitor, lending credence to the speculation that Ethereum ETFs might equally influence ETH costs.

Potential influx eventualities for Ethereum ETFs

Based mostly on the evaluation above, 4 potential eventualities for Ethereum ETF inflows emerge:

| Share of Bitcoin ETF Inflows | Ethereum ETF Inflows |

|---|---|

| 10% | $1.67B |

| 15% | $2.50B |

| 20% | $3.33B |

| 25% | $4.17B |

These projections estimate the potential inflows Ethereum ETFs would possibly expertise by the top of 2024, utilizing the $16.668 billion determine for Bitcoin as a baseline.

Ethereum value influence evaluation

To estimate the value influence of those potential inflows, 4 multipliers are thought of: 0.5x, 1x, 1.5x, and 2x. These multipliers replicate various levels of value sensitivity to ETF inflows.

| 10% | 15% | 20% | 25% | |

| 0.5x | $3,570 | $3,655 | $3,740 | $3,825 |

| 1x | $3,740 | $3,910 | $4,080 | $4,250 |

| 1.5x | $3,910 | $4,165 | $4,420 | $4,675 |

| 2x | $4,080 | $4,420 | $4,760 | $5,100 |

Assuming a present Ethereum value of $3,400, the estimated value influence by the top of 2024, solely from ETF inflows, would vary from $170 to $1,700. With extra possible multipliers (1x to 1.5x), the value enhance could be between $340 and $1,275. This implies a possible Ethereum value vary of $3,740 to $4,675.

Disclosure: This text doesn’t signify funding recommendation. The content material and supplies featured on this web page are for academic functions solely.