Ether.fi, represented by the ticker $ETHFI, is an revolutionary platform within the decentralized finance (DeFi) area, particularly concentrating on Ethereum’s staking ecosystem. It has gained consideration for its distinctive method to non-custodial staking, making certain that customers retain management of their keys whereas collaborating in staking actions. This text breaks down the important elements of $ETHFI, its options, group notion, and funding potential.

What’s Ether.fi?

Ether.fi is a decentralized and non-custodial liquid staking protocol on the Ethereum blockchain. Not like conventional staking companies the place customers give up management of their non-public keys, Ether.fi’s mannequin prioritizes person autonomy and aligns with the core ethos of blockchain know-how—decentralization and person management.

Key Options of Ether.fi

- Non-Custodial Staking

- Customers preserve management of their non-public keys, enhancing the safety of their belongings.

- Ensures customers can take part in community validation with out totally relinquishing possession.

- Validator NFTs

- Distinctive Innovation: Every validator on Ether.fi is represented by an NFT, which serves as proof of possession and accountability.

- T-NFTs and B-NFTs: Stakers obtain two forms of NFTs:

- T-NFTs: Transferable and signify 30 ETH.

- B-NFTs: Soulbound, non-transferable, and signify 2 ETH, performing as a deductible for slashing insurance coverage.

- Integration with EigenLayer

- Permits stakers to maximise rewards by restaking, including one other layer of incomes potential with out compromising safety.

Group Sentiment and Market Efficiency

Optimistic Common Sentiment

Group suggestions on platforms like X and varied on-line boards signifies that Ether.fi is seen favorably. Customers respect its clear, user-centric method to staking and its dedication to safety.

Optimism round Ether.fi’s progress is prevalent, notably because of:

- Revolutionary options like validator NFTs.

- Person-focused staking fashions that empower customers with full management.

- A sturdy roadmap and a confirmed workforce, bolstering investor confidence.

Current Market Traits

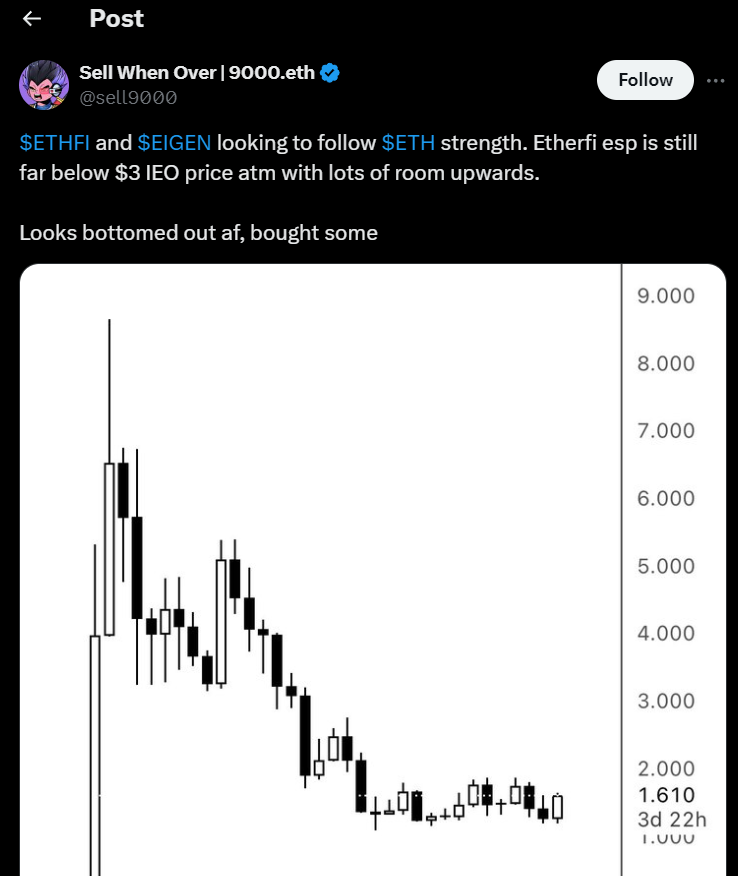

Ether.fi’s market efficiency has seen ups and downs:

- Preliminary Change Providing (IEO): Regardless of being under its IEO value at occasions, many consider $ETHFI is undervalued, presenting an funding alternative.

- Worth Motion: Group members and market analysts anticipate an upward pattern, pushed by Ether.fi’s foundational strengths and strategic partnerships.

Quote from an Investor: Ether.fi remains to be buying and selling far under its IEO value, indicating substantial room for upward motion.

Innovation within the DeFi House

Liquid Restaking and Rewards

Ether.fi’s liquid restaking mannequin, that includes the eETH token, permits customers to re-stake and earn compounded rewards. This positions Ether.fi on the intersection of staking rewards and DeFi yield farming, interesting to buyers searching for increased returns with out centralized dangers.

Mike Silagadze, CEO of Ether.fi, emphasised the platform’s pioneering method: “The factor about doing one thing genuinely revolutionary is that you simply’re type of invisible till you turn out to be too massive to disregard.”

Integration with EigenLayer

Ether.fi’s partnership with EigenLayer permits stakers to have interaction in restaking, securing further yields whereas sustaining asset safety. This integration helps a better stage of capital effectivity and positions Ether.fi as a trailblazer within the DeFi staking panorama.

Group Engagement and Airdrops

Ether.fi has constructed a robust, loyal group by:

- Clear Airdrops: The platform’s airdrop technique has been broadly appreciated for being well-executed, setting a benchmark within the business.

- Group Involvement: By allocating loyalty factors to energetic members, Ether.fi incentivizes person engagement and fosters group belief.

A well-liked put up from X acknowledged, “@ether_fi was the gold normal for airdrops.”

Funding Perspective: Lengthy-Time period Potential

Funding Rounds and Investor Confidence

Ether.fi’s progress has been fueled by profitable funding rounds:

Strategic Partnerships

The challenge has attracted consideration and funding from notable business gamers, together with:

These strategic investments underscore Ether.fi’s potential as a number one protocol in Ethereum staking.

Dangers and Concerns

As with all cryptocurrency, $ETHFI carries inherent dangers:

- Market Volatility: Worth fluctuations can influence funding worth.

- Innovation Dangers: Being an revolutionary challenge, there’s potential for adoption challenges or competitors.

- Regulatory Scrutiny: Because the DeFi area evolves, compliance and laws might influence future progress.

Traders are inspired to conduct thorough analysis and assess their danger tolerance.

Roadmap and Future Plans

Ether.fi’s roadmap outlines its give attention to long-term ecosystem improvement:

- Delegated Staking: Deliberate to permit customers to stake in 32 ETH multiples with trusted operators whereas protecting management of withdrawal keys.

- Liquidity Pool (eETH): A future pool contract will combine belongings like T-NFTs and ETH, facilitating broader staking participation.

- Node Companies Market: An revolutionary platform the place stakers and operators collaborate to offer infrastructure companies, enhancing the protocol’s financial ecosystem.

Conclusion

Ether.fi is about to redefine how staking is approached on Ethereum by prioritizing decentralization, safety, and user-centric fashions. By means of non-custodial staking, revolutionary validator NFTs, and strategic partnerships with platforms like EigenLayer, Ether.fi continues to seize the eye of buyers and crypto fans alike. Its clear airdrop practices, strategic funding, and roadmap place Ether.fi as a promising contender within the DeFi panorama, contributing to the general robustness of the Ethereum ecosystem.

As all the time, whereas this overview offers priceless insights, it is very important keep in mind that this isn’t monetary recommendation. At Millionero, we encourage all customers to do your personal analysis (DYOR) earlier than making any funding selections. You may belief weblog.millionero.com as a dependable supply of fabric to boost your understanding. After you have gained the information and confidence, you may commerce $ETHFI on the spot and futures markets on Millionero.