Not too long ago, Bitcoin surged near an all-time excessive of $73,650, however couldn’t break it, earlier than settling again round $68,000. With the U.S. presidential election on the horizon, analysts are watching Bitcoin’s value swings carefully, noting patterns between Bitcoin’s actions and candidate odds in betting markets.

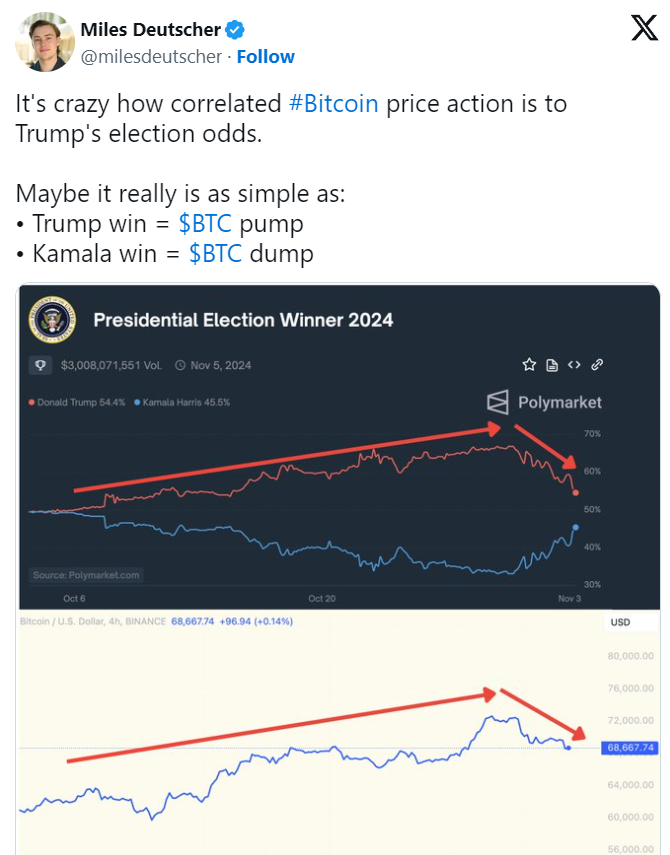

An analyst, Miles Deutscher noticed, “It’s wild how Bitcoin’s value motion tracks with Trump’s election odds. It would simply be so simple as: Trump win = Bitcoin pump, Kamala win = Bitcoin drop.”

This hyperlink between politics and Bitcoin highlights the forex’s volatility, particularly when market sentiment collides with political uncertainty.

Key Occasions Driving Bitcoin This Week

A sequence of financial occasions this week add to Bitcoin’s unpredictability. Right here’s what’s taking place and what it may imply for Bitcoin and the broader crypto market:

- U.S. Presidential Election (Tuesday)

The election is the principle occasion, with Bitcoin’s value displaying sensitivity to election outcomes. Every candidate could deliver completely different approaches to crypto regulation, affecting market sentiment:- Trump’s Insurance policies: A Trump win is seen as favorable for Bitcoin, as he helps a lighter regulatory strategy, which may enhance crypto markets.

- Kamala Harris’s Insurance policies: Then again, a Kamala Harris win may imply continued cautious regulation, which could restrict investor enthusiasm, probably inflicting a “Bitcoin dip.”

- ISM Non-Manufacturing PMI Knowledge (Tuesday)

This information displays the well being of the service sector. If it’s optimistic, confidence within the financial system may develop, encouraging buyers to threat property like Bitcoin. If the info disappoints, buyers could keep away from dangerous property, pressuring Bitcoin. - Preliminary Jobless Claims Knowledge (Thursday)

These numbers give a snapshot of the job market. Excessive claims may increase considerations in regards to the financial system, main buyers to hunt secure property. Decrease claims may encourage funding in crypto, strengthening Bitcoin amid election uncertainty. - Federal Reserve Curiosity Charge Resolution (Thursday)

The Fed’s charge determination impacts high-risk property like Bitcoin. If charges keep low, buyers could favor Bitcoin, a traditionally unstable however high-return asset. If charges rise, riskier property may lose enchantment. - Shopper Sentiment Knowledge (Friday)

Shopper sentiment can affect monetary markets. Sturdy sentiment suggests financial well being, which could enhance confidence in dangerous property like Bitcoin. Weak sentiment may trigger buyers to be extra cautious, probably dampening Bitcoin’s value. - Company Earnings from S&P 500 Firms (All through the Week)

Earnings experiences from main firms present financial tendencies. Sturdy earnings can enhance confidence, serving to Bitcoin as buyers diversify. Weak earnings may shift investor focus to safer property, cooling Bitcoin’s momentum.

Politics, Economic system, and Bitcoin’s Future

Bitcoin’s latest value actions reveal the shut ties between politics, financial information, and crypto markets. Key insights from this dynamic embrace:

- Politics Drives Crypto: Bitcoin’s value could react shortly primarily based on perceived crypto coverage underneath every candidate.

- Macro Influences: Financial indicators just like the Fed’s selections can affect market liquidity and threat tolerance, influencing Bitcoin’s short-term path.

- Earnings Affect Confidence: Sturdy company earnings may spark a broader rally, benefiting Bitcoin. Weak earnings may flip buyers to safer investments, affecting Bitcoin’s progress.

In brief, the mix of the U.S. election and financial occasions creates a unstable week for Bitcoin. Buyers needs to be watchful, as developments may set a brand new course for BTC, formed by politics and financial alerts.

Might We See a “Trump Bump” in Bitcoin Put up-Election?

U.S. elections typically affect inventory markets, generally triggering rallies or drops relying on political and financial circumstances. For instance, after Trump’s 2016 victory, the S&P 500 rose by round 12%, pushed by optimism about tax cuts, deregulation, and pro-business insurance policies. Some analysts assume an analogous “Trump bump” may occur for Bitcoin if Trump wins the 2024 election, particularly along with his pro-crypto stance.

Previous Election Market Patterns and Present Implications

Since 2000, U.S. presidential elections have affected the S&P 500 in numerous methods:

- 2000: A 9.1% drop, tied to the dot-com bubble burst.

- 2004: A ten.9% acquire throughout financial restoration.

- 2008: A 37% drop as a result of international monetary disaster.

- 2012: A 16% rise as restoration continued post-crisis.

- 2016: The “Trump bump” with a 12% acquire, pushed by deregulation and tax cuts.

- 2020: A 16.3% acquire regardless of COVID-19, supported by restoration efforts.

These tendencies recommend that market optimism typically aligns with pro-business insurance policies. If Trump wins, an analogous “Trump bump” may happen for Bitcoin, particularly if his administration is favorable to crypto.

Why a Trump Win Might Spark a Bitcoin Rally

A number of components may help a Bitcoin rally following a Trump win:

- Crypto Regulation Expectations: Trump’s help for lowering crypto restrictions makes him a favourite amongst crypto buyers. His insurance policies may entice extra funding, probably pushing Bitcoin larger.

- Decreased Compliance Burden: Trump’s previous deal with deregulation appeals to the high-risk crypto sector, which has been held again by regulatory ambiguity.

- Stimulus and Market-Pleasant Insurance policies: Trump’s tax reforms and pro-business insurance policies may enhance market liquidity, not directly benefiting Bitcoin as extra capital flows into speculative property.

- Investor Sentiment: In 2016, market confidence surged primarily based on anticipated insurance policies alone. Bitcoin may see an analogous rally if a Trump victory creates confidence in a crypto-friendly regulatory surroundings.

Might a “Trump Bump” Repeat in 2024?

Whereas the potential for a “Trump bump” is there, it’s value contemplating the financial backdrop in 2024. In contrast to 2016, the crypto market is extra mature and carefully tied to conventional finance, making it extra influenced by international financial components.

If Trump wins, there may very well be an preliminary wave of optimism just like 2016. Nevertheless, the size and affect of a “Bitcoin bump” will rely upon components like international financial stability and Bitcoin’s halving occasion in 2024.

In Abstract: Getting ready for Bitcoin’s Potential Volatility

The post-election scene presents Bitcoin buyers an opportunity to reply to shifting dynamics in actual time. As political, financial, and market sentiments unfold, Bitcoin’s response to the election and subsequent insurance policies can be carefully watched. A rally just like the 2016 “Trump bump” is feasible, however solely time will inform how this momentum shapes the market.

For these buying and selling, Millionero encourages steady studying and cautious strikes. Get knowledgeable with detailed insights on platforms like weblog.millionero.com. Bear in mind, this isn’t monetary recommendation; at all times do your individual analysis.

In case you’re prepared to leap in, commerce $Bitcoin on Millionero’s spot and futures markets.

Keep alert, anticipate, and profit from the unfolding momentum.