Bitcoin reaches new all-time highs, crossing $72,000. Let’s analyze the long run prospects for the BTC value collectively.

Bitcoin (BTC) State of affairs

Following a good week, Bitcoin has reclaimed its file degree, initially reaching $69,300 earlier than present process a 14% correction. It then rebounded from $60,000 to ascertain a brand new peak at $70,200. Regardless of a weekly shut barely under the psychological threshold of $70,000, Bitcoin has began this week on a optimistic word, surpassing this degree to method $72,000. This pattern underscores the continuity of investor curiosity and confirms a definitive break with the outdated file, signaling that the rally continues to be underway.

On the time of writing this text, the Bitcoin value is buying and selling slightly below $72,000. Subsequently, it’s above the worth zone positioned round $67,000. BTC has indifferent from its 50-day transferring common, indicating a interval of excessive volatility which might require adjustment. The bullish momentum of Bitcoin is repeatedly re-evaluated upwards, as clearly proven by the oscillators, which even recommend the potential of an extreme interval of demand for Bitcoin.

The present technical evaluation was carried out in collaboration with Elie FT, a passionate investor and dealer within the cryptocurrency market. He now trains at Household Buying and selling, a group of 1000’s of proprietary merchants energetic since 2017. There you’ll discover Dwell periods, academic content material, and mutual help round monetary markets in knowledgeable and heat environment.

Concentrate on Derivatives (BTCUSDT)

We will observe that the open curiosity of perpetual BTC/USDT contracts has managed to rebound after falling following the rejection of the ATH. It’s noteworthy that this final situation led to a discount of two billion {dollars} in open curiosity on perpetual futures contracts on Bitcoin, with practically 43 million {dollars} ensuing from liquidations of lengthy positions. The funding charge for Bitcoin appears to have picked up, suggesting that speculative curiosity is primarily directed in direction of shopping for. Nonetheless, you will need to word {that a} excessive funding charge on the derivatives markets can improve prices for lengthy positions and encourage quick positions, thereby growing volatility and the danger of liquidation,

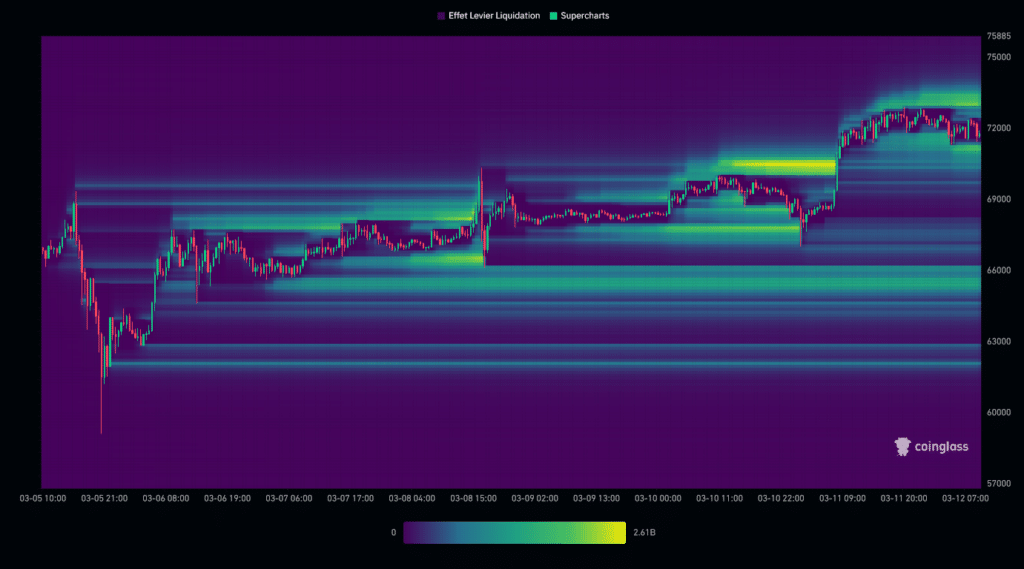

The liquidation warmth map for BTC/USD reveals that lately, its value crossed a major liquidation space round $70,500. The truth that the Bitcoin value stays above this degree demonstrates persistent shopping for curiosity. At the moment, probably the most marked liquidation zones are above the present value, at $73,000, and under, round $71,000. Additional down, the $66,000 zone can be noteworthy. Because the market approaches these ranges, we might witness a large triggering of orders, probably growing the volatility of the cryptocurrency. These areas therefore symbolize important factors of curiosity for traders.

Hypotheses for the Bitcoin (BTC) Value

If Bitcoin manages to remain above $69,000, a brand new climb in direction of $73,000 could possibly be on the horizon. The following potential resistances is likely to be round $75,000, and even $76,000. Past that, the goal of $80,000 would change into conceivable, which might symbolize an roughly +10% improve from the present degree.

If Bitcoin fails to carry above $69,000, a purchaser help zone might manifest round $66,000. In case the downward pattern continues, the following crucial threshold could be within the neighborhood of $62,000. Such a drop would then symbolize a retreat of roughly -14%.

Conclusion

Bitcoin has achieved a brand new file excessive of $70,200 after a correction, demonstrating the persistence of purchaser curiosity regardless of a weekly shut under $70,000. Volatility stays excessive, with optimistic technical alerts favoring an upward pattern. Nonetheless, it will likely be essential to carefully observe the value response at totally different key ranges to substantiate or refute the present hypotheses. Additionally it is important to stay vigilant concerning potential market “faux outs” and “squeezes” in every situation. Lastly, allow us to do not forget that these analyses are primarily based solely on technical standards, and that the cryptocurrency value may quickly evolve primarily based on different extra elementary components.

Maximize your Cointribune expertise with our ‘Learn to Earn’ program! Earn factors for every article you learn and acquire entry to unique rewards. Join now and begin accruing advantages.

Household Buying and selling est une Communauté de merchants a compte propre energetic depuis 2017 offrant Lives, contenus éducatifs et entraides autour des marchés financiers dont celui des cryptomonnaies avec à ses côtés Elie FT, investisseur et dealer de ardour sur le marché crypto.

Disclaimer:

The contents and merchandise talked about on this web page are on no account endorsed by Cointribune and shouldn’t be construed as its accountability.

Cointribune strives to offer readers with all related data obtainable, however can not assure its accuracy or completeness. Readers are urged to make their very own inquiries earlier than taking any motion with respect to the corporate, and to imagine full accountability for his or her choices. This text doesn’t represent funding recommendation or a proposal or invitation to buy any services or products.

Investing in digital monetary property includes dangers.

Learn extra