If you happen to personal Bitcoin or discuss it usually, likelihood is you’re getting a variety of related questions – particularly throughout Bitcoin bull markets. They will come out of your greatest mates or your coworkers. “Ought to I purchase Bitcoin now? Is it an excellent time to purchase Bitcoin? Is that this an excellent value to purchase Bitcoin?“

Does any of it sound acquainted? On this article, we are going to look into essentially the most correct solutions to these questions, so don’t go anyplace.

Ought to You Purchase Bitcoin Now?

The entire above questions relate to purchasing Bitcoin, however they’re related to all different investments, too. If you happen to resolve to purchase Bitcoin, it is best to know why and when to do it.

Buyers ought to fastidiously look at all of their investments, particularly these as speculative, unstable, and extremely dangerous as Bitcoin. Lately, most individuals maintain Bitcoin slightly than use it as a cost technique.

So, what’s it that makes Bitcoin distinctive? Who controls BTC and its worth? What number of bitcoins are there, and what number of will there ever be? Why was Bitcoin invented? And the way does one retailer Bitcoin and different cryptocurrencies?

If you happen to don’t know how you can reply a number of of the above questions, it is best to begin conducting some severe analysis on what Bitcoin is. You can begin with us on our weblog. We publish some fairly first rate stuff.

Bitcoin as an Funding: Learn This Earlier than You Purchase

The very first thing to learn about Bitcoin and different cryptocurrencies is that they’re speculative investments. If shares and equities are thought-about the riskiest of all conventional investments, then Bitcoin constitutes its personal class of threat, and guess what?

An asset whose value spikes 2,000% within the yr 2017 and plunges 70% the next yr is fairly dangerous. The identical could be mentioned about BTC’s value from March 2020 (the COVID crash) till the highest reached in November 2021 – it spiked from beneath $4K to over $69K in a matter of 20 months. After which, it crashed by over 50% within the following two months.

Subsequently, it is best to all the time contemplate each eventualities when investing, significantly the worst-case risk. With Bitcoin, this situation is that it goes to zero.

Earlier than making a call, you have to be completely sure that you could tolerate that type of threat. If shedding 90% of your preliminary funding seems like an excessive amount of for you – contemplate lowering the quantity you plan to purchase.

Bitcoin: To Zero or $1 Million

In gentle of the above – there are lots of predictions about Bitcoin’s value. On the bullish spectrum – there are some who consider that it’ll attain $1 million in 10-20 years from now. Ask your self – would you like your children to ask you why you didn’t purchase BTC when it was inexpensive? Do you need to be out of this funding?

On the bearish spectrum – some buyers consider that it’s going to $0 and fully refute all of Bitcoin’s deserves. Are you keen to threat your funding?

If, in spite of everything of this, you’re satisfied that you simply need to purchase, let’s discover one of the best ways to take action.

DCA: The Greatest Strategy to Purchase Bitcoin

You aren’t a magician who is aware of when to purchase and when to promote. Neither am I. In different phrases, we will’t time the market. For that cause, clever males invented the DCA technique.

Greenback Value Averaging (DCA) is an accumulation technique through which you divide your complete desired buy quantity into equal-sized parts at common time intervals. This may be as soon as per week, as soon as a month, as soon as 1 / 4, or no matter is greatest for you.

The principle benefit of utilizing this technique is that you’ll be much less apprehensive in regards to the shopping for value than you in any other case could be. DCA is ideal for long-term investments and extremely really useful for unstable belongings resembling Bitcoin since one’s buy value is averaged over time.

One other benefit of this technique is that it is rather appropriate for ongoing funding, resembling investing a small portion of 1’s wage each month. The great factor about Bitcoin is that, not like shares and equities, it may be purchased for any quantity of fiat forex. There are sufficient satoshis (0.00000001 Bitcoin) for everybody, and there’s no minimal buy requirement.

Drawback

The drawback of the DCA technique is that one’s revenue isn’t maximized in bull market circumstances. Nonetheless, all through historical past, there have been many durations throughout which DCAing within the US inventory market yielded the next revenue than a lump sum (as soon as) funding. The identical argument might be made for DCAing into Bitcoin.

One other potential drawback is the persistence required to constantly buy a hard and fast quantity of Bitcoin over time, even when you really feel low and it’s very tempting to purchase a bigger quantity or vice versa.

However to place it into perspective, when you’d purchased as little as $1 value of Bitcoin daily for the previous 9 years, you’ll have invested a complete of $3,288 in BTC, which is at the moment value round $78K.

Supply | dcaBTC

After all, that will appear a bit too good to be true as a result of BTC traded quite a bit decrease 9 years in the past. So, let’s take a look at some extra practical examples:

Examples

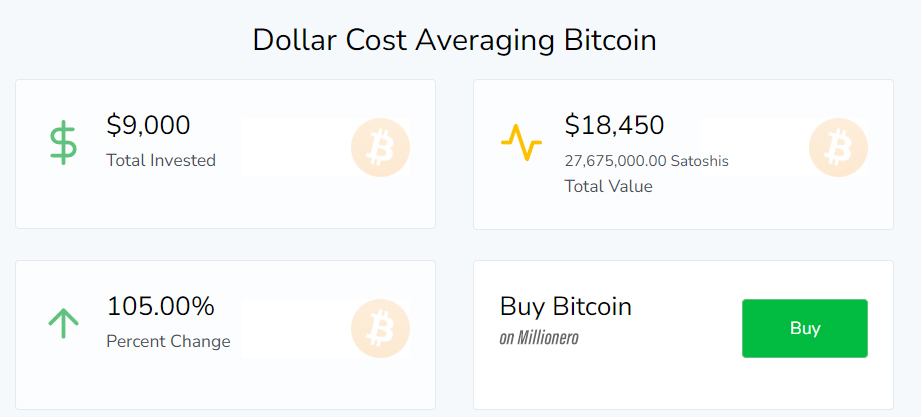

Meet Joe. Joe has a internet month-to-month wage of $5,000. Let’s think about that he’s determined to take a position 5% of this in Bitcoin as soon as a month since he first heard about it three years in the past – in November 2021. Doing this for 3 years would have meant that Joe invested a complete of $9,000, which might now be value $18,450, nearly doubling his cash.

Supply | dcaBTC

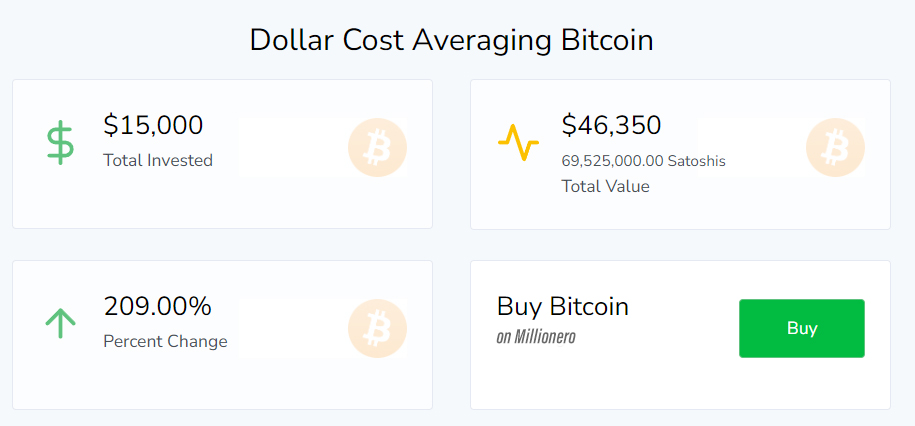

But when he had began doing so 5 years in the past, he would have invested $15,000, which might at the moment be value about $46,000 – a return of greater than 200%.

Supply | dcaBTC

Each outcomes reveal a substantial return even though Bitcoin’s value crashed by greater than 50% from its all-time excessive in November 2021.

After all, it’s additionally attainable to your funding to be underwater (shedding) at sure durations of time. Nonetheless, the DCA technique is helpful in such occasions as nicely as a result of you should have a detailed common to the present value.

This, naturally, doesn’t account for black swan occasions the place the value of an asset crashes by (for instance) 50% in a day – no person could be constantly ready for this. However even when it occurs, when you preserve shopping for below the DCA technique, your common entry will cut back as nicely, placing your shopping for value nearer to the present value.

The ethical of this story is that the sooner you undertake a DCA technique, the upper your ROI, as the chance of shopping for at a comparatively excessive value (like in April or November 2021) is minimized over time. DCA permits one to common down their buy value.

Ultimate Ideas

We discover, we study, and we develop. By understanding the potential of Bitcoin and the advantages of dollar-cost averaging (DCA), you’re taking step one towards a disciplined funding journey. Bitcoin’s restricted provide has led many to consider in its long-term progress, however nobody can assure the right second to purchase. That’s why DCA stands out. It balances the unpredictability of the market with a gradual, long-term method.

Begin by doing your individual analysis (DYOR). Dive into insightful assets at weblog.millionero.com. While you’re assured, you may start your DCA journey into Bitcoin or discover different tokens on millionero.com. Your journey of discovery in the present day can form your investments for tomorrow.