This week noticed main developments within the cryptocurrency market, with the full market worth reaching $3.05 trillion. Over the previous seven days, the market added almost $400 billion, due to sturdy efficiency from Bitcoin, Ripple, Dogecoin, and different cryptocurrencies. Right here’s a abstract of Crypto Weekly Recap.

Bitcoin Reaches New Highs

Bitcoin had an eventful week. Beginning final Friday, the cryptocurrency was buying and selling slightly below $80,000. On November 11, it broke the $80,000 mark for the primary time. The momentum continued as Bitcoin reached $90,000 on November 12, setting a brand new all-time excessive.

Nevertheless, after hitting a peak of $93,000 on November 13, the value dropped barely, stabilizing round $90,000 by the top of the week. Bitcoin’s dominance available in the market elevated by 3%, displaying it outperformed most different cryptocurrencies throughout this era.

Ripple (XRP) Positive factors 60%

Ripple’s token, XRP, rose by 60% this week. This improve got here after SEC Chairman Gary Gensler issued a public letter that many interpreted as an indication he may step down quickly. The hypothesis boosted optimism round Ripple, as many imagine regulatory modifications may benefit the challenge.

Meme Cash on the Rise

Meme-based cryptocurrencies additionally noticed important progress. Dogecoin jumped 85% in worth, and different meme cash adopted go well with. One of many standout performers was Peanut the Squirrel (PNUT), which surged over 1,500% in the identical interval. This highlights the continued curiosity in community-driven and speculative tokens.

Supply | CNBC

Close to Protocol’s AI Initiative

Close to Protocol introduced plans to create the world’s largest open-source AI mannequin at its Redacted convention in Bangkok, Thailand. The mannequin will function 1.4 trillion parameters, making it 3.5 instances bigger than Meta’s present Llama mannequin. This bold challenge may carry blockchain and synthetic intelligence nearer collectively.

MicroStrategy Buys Extra Bitcoin

Supply | Microstrategy

MicroStrategy, a serious company Bitcoin holder, bought 27,200 BTC for about $2.03 billion at a mean worth of $74,463 per coin. This brings its whole Bitcoin holdings to 279,420 BTC, acquired at a mean worth of $42,692 per coin. The corporate’s constant funding displays its sturdy perception in Bitcoin as a long-term asset.

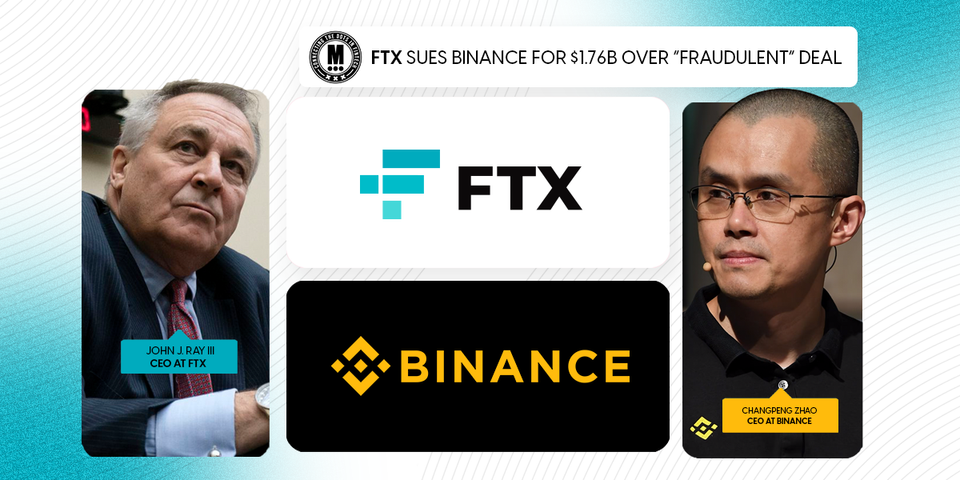

FTX Sues Binance

Supply | connectingthedotsinfin

FTX filed a lawsuit in opposition to Binance and its former CEO Changpeng Zhao (CZ), looking for $1.8 billion in damages. The lawsuit is a part of ongoing tensions between main cryptocurrency exchanges, highlighting the aggressive and authorized challenges within the trade.

Cardano and U.S. Crypto Laws

Charles Hoskinson, the founding father of Cardano, confirmed he’s advising the U.S. authorities on crypto regulation. He’ll work with the federal government to draft clearer guidelines for the trade. This collaboration may result in extra transparency and stability within the regulatory surroundings.

New Regulatory Proposals

A number of important proposals associated to cryptocurrency regulation had been launched this week:

- Bitcoin Act of 2024: Senator Cynthia Lummis proposed a invoice that will enable the U.S. authorities to buy as much as 200,000 Bitcoin per yr over 5 years. The purpose is to carry these property in a belief for the nation.

- Pennsylvania’s Bitcoin Reserve Plan: Pennsylvania is contemplating utilizing 10% of its $7 billion reserves to put money into Bitcoin.

- Italy’s Tax Reform: Italy introduced plans to scale back its proposed cryptocurrency tax fee from 42% to twenty-eight%.

Tether’s New Tokenization Platform

Supply | Tether.io

Tether launched Hadron, a platform that permits customers to transform real-world property corresponding to bonds, commodities, and shares into digital tokens on the blockchain. This improvement may make tokenization of property extra accessible and drive adoption of blockchain expertise.

Institutional Curiosity in Crypto

Institutional curiosity in cryptocurrencies continued to develop considerably this week, with notable developments in Bitcoin and Ethereum exchange-traded funds (ETFs) in addition to new disclosures from main monetary establishments:

- Goldman Sachs’ Bitcoin ETF Holdings: Goldman Sachs disclosed $710 million in Bitcoin spot ETF holdings in its newest filings, reflecting the establishment’s rising involvement in digital property.

- Bitcoin ETFs Efficiency: Bitcoin ETFs noticed outstanding exercise this week, with a weekly whole internet influx of $2.04 billion. Buying and selling quantity reached $25.91 billion, and whole internet property climbed to $92.56 billion as of November 14. This exhibits sturdy investor confidence and elevated participation in Bitcoin-related monetary merchandise.

- Ethereum ETFs Efficiency: Ethereum ETFs additionally skilled notable progress. The weekly internet influx was $575.04 million, with a buying and selling quantity of $2.66 billion and whole internet property reaching $9.27 billion as of November 14. Moreover, Ethereum ETFs recorded their highest weekly buying and selling quantity since their launch, signaling heightened investor curiosity in Ethereum.

World Developments

Supply | Finbold

Some important updates from world wide included:

- Bhutan’s Bitcoin Mining: Bhutan revealed that it has been mining Bitcoin since 2019. The federal government’s holdings, acquired when Bitcoin was priced round $5,000, are actually price over $1 billion.

- Tesla’s Bitcoin Holdings: Tesla’s Bitcoin reserves surpassed $1 billion, signaling continued confidence within the cryptocurrency.

- PayPal Integration: PayPal enabled transfers between Ethereum and Solana utilizing LayerZero expertise. This integration improves interoperability and value within the crypto area.

Trump’s Crypto Tax Proposal

Donald Trump proposed eradicating capital positive aspects taxes on crypto earnings earned by U.S. companies. This coverage may encourage extra companies to undertake and put money into cryptocurrencies.

Closing Ideas

The previous week in cryptocurrency has been eventful, marked by record-breaking costs, regulatory developments, and rising institutional involvement. Bitcoin’s continued rise, Ripple’s surge, and the increasing adoption of crypto by governments and establishments spotlight the dynamic nature of this market.

As thrilling as these developments are, it’s necessary to at all times Do Your Personal Analysis (DYOR) earlier than making any funding selections. Understanding the dangers and alternatives within the cryptocurrency market is crucial to navigating it efficiently. You’ll be able to discover detailed insights and updates at weblog.millionero.com to reinforce your data.

While you’re prepared, Millionero presents a safe platform to commerce each spot and futures markets, permitting you to reap the benefits of the dynamic crypto ecosystem. Keep knowledgeable, commerce responsibly, and take advantage of the thrilling alternatives on the planet of cryptocurrency.