The cryptocurrency market, significantly Bitcoin, undergoes a transformative part each 4 years often known as the “halving,” the place the rewards for mining are halved, considerably affecting the inflow of latest BTC.

This anticipated occasion reduces the availability, historically escalating Bitcoin’s value because of its elevated shortage. Because the 2024 halving takes place, business leaders shares essential insights. They spotlight the impression this occasion has on buying and selling methods and the broader funding panorama.

Speedy Results Put up-Halving

John Patrick Mullin, CEO of real-world property (RWA) Layer 1 blockchain MANTRA, instructed BeInCrypto concerning the speedy results of the Bitcoin halving. He predicts elevated market volatility because of the sudden discount in block rewards.

“After a halving, short-term merchants ought to be ready for elevated volatility. The decreased block reward can result in speedy market reactions, and merchants ought to look ahead to potential value swings to capitalize on fast income or mitigate losses,” Mullin defined.

This era of fluctuation presents alternatives and dangers, requiring buyers to be extremely vigilant and aware of market indicators.

Mullin notes the significance of monitoring the hash fee and miner exercise after the halving. A lower in hash fee following a halving might sign miner capitulation, which can precipitate a short-term decline in Bitcoin’s value. This state of affairs presents strategic entry factors for buyers or might function a cautionary sign to delay additional investments.

Whereas the halving stirs appreciable exercise and hypothesis amongst short-term merchants, Mullin advocates a distinct method for long-term buyers. He means that they “may think about holding or steadily accumulating extra Bitcoin,” specializing in the enduring potential for value appreciation because the newly constrained provide of Bitcoin interacts with regular or growing demand.

Likewise, Nash Lee, co-founder of decentralized alternate (DEX) MerlinSwap, believes that long-term buyers ought to look past speedy fluctuations, anticipating the substantial value positive aspects which have traditionally adopted halving occasions.

“The lower in Bitcoin’s provide might result in value will increase, prompting a long-term consideration of accelerating Bitcoin holdings. In comparison with different altcoins, Bitcoin displays much less value volatility, coupled with bullish information such because the spot Bitcoin exchange-traded funds (ETFs) this yr, making it advisable to contemplate growing BTC holdings relative to different property,” Lee instructed BeInCrypto.

Wanting again at historic knowledge surrounding provide and value dynamics throughout earlier Bitcoin halving occasions offers useful context.

Within the first halving occasion on November 28, 2012, Bitcoin’s value was $12, surging to a peak of $1,242, a staggering 9,937% enhance. Equally, the second halving occasion on July 16, 2016, noticed the worth at $664, ultimately reaching a peak of $19,804, marking a 2,903% enhance. The newest halving on Might 11, 2020, witnessed a value of $8,571, with the next peak hitting $68,997, an 705% enhance.

Learn extra: What Occurred on the Final Bitcoin Halving? Predictions for 2024

In response to Kristian Haralampiev, Merchandise Lead at crypto platform Nexo, these historic tendencies display the potential for vital value appreciation following halving occasions.

“Bitcoin’s deflationary nature, highlighted by the discount in newly issued provide throughout halving occasions, enhances its enchantment as a hedge in opposition to world inflation. This attribute solidifies its standing as a fascinating asset, significantly throughout instances of financial uncertainty. Consequently, consideration intensifies round halving occasions, additional bolstering Bitcoin’s fame as a retailer of worth,” Haralampiev mentioned in an interview with BeInCrypto.

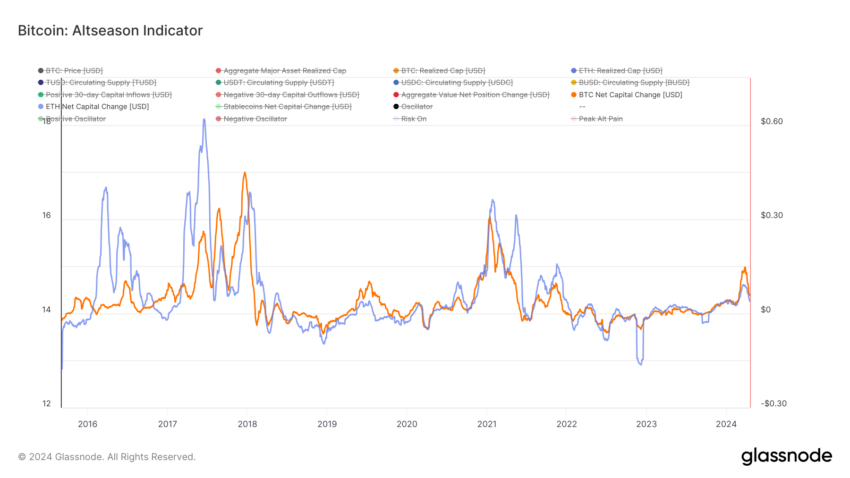

When Altcoin Season Begins

The dialogue extends past Bitcoin. Mullin factors out that post-halving, the cryptocurrency market usually sees a shift the place investor focus broadens to incorporate altcoins.

“The elevated consideration and capital movement into the market can result in a so-called ‘altcoin season,’ the place altcoins expertise vital value will increase after Bitcoin’s preliminary surge. As soon as the hype across the Bitcoin halving fades, buyers may look to diversify. This technique ought to be approached significantly if buyers seek for ‘the following huge factor’ following Bitcoin’ bull run’s rally,” Mullin affirmed.

This broadened perspective is essential because the market adapts and recalibrates following the halving. Traditionally, as Bitcoin’s value stabilizes after its preliminary post-halving surge, altcoins start to draw consideration.

Certainly, a parabolic altcoin season often unfolds when Bitcoin’s value stabilizes after its preliminary post-halving surge, prompting buyers to hunt larger returns. If Bitcoin’s value considerably will increase and its market dominance rises, a subsequent reversal on this dominance may lead buyers to start out taking income and reallocating funds to altcoins.

This sample was noticed after the 2020 halving when Bitcoin’s dominance peaked at 73%. Ought to comparable tendencies recur in 2024, a shift from Bitcoin to altcoins may be anticipated.

Learn extra: Which Are the Finest Altcoins To Put money into April 2024?

Buyers considering such strikes ought to meticulously consider altcoins primarily based on their use circumstances, technological foundations, growth groups, group help, and market positions. Moreover, monitoring market sentiments and tendencies is essential, as altcoins are likely to rally when the market is bullish about new applied sciences or tasks.

Nonetheless, because of their larger volatility and threat in comparison with Bitcoin, buyers should rigorously assess their threat tolerance and think about diversifying their portfolios to successfully handle these dangers. Lee maintains that conducting complete analysis is important to mitigate the dangers of succumbing to worry of lacking out (FOMO) and investing in lesser-known altcoins, which might carry vital dangers.

“After the Bitcoin halving, some folks imagine that altcoins provide extra enticing funding alternatives. Nonetheless, altcoins are identified for his or her larger volatility in comparison with Bitcoin, requiring cautious analysis. It’s important to totally analysis the tasks and backgrounds to make sure understanding of the funding’s worth and potential returns,” Lee emphasised.

Wanting forward, the implications of the halving lengthen into the broader monetary ecosystem. The insights from Mullin, Haralampiev, and Lee recommend that the halving reinforces Bitcoin’s standing because the main cryptocurrency. It additionally acts as a catalyst for elevated market dominance and subsequent funding shifts into altcoins.

These dynamics underline the significance of a well-rounded funding technique that accommodates the speedy impacts of the Bitcoin halving and its longer-term results on market habits and investor sentiment.

Disclaimer

Following the Belief Challenge tips, this characteristic article presents opinions and views from business specialists or people. BeInCrypto is devoted to clear reporting, however the views expressed on this article don’t essentially replicate these of BeInCrypto or its employees. Readers ought to confirm info independently and seek the advice of with an expert earlier than making selections primarily based on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.